Rising Commercial Vehicle Production and Sales Bolsters Heavy Commercial Vehicle Clutch Market Growth

According to our latest study on "Heavy Commercial Vehicle Clutch Market Analysis to 2031 – Geography Analysis – by Distribution Channel, Product, and Vehicle Type," the market was valued at US$ 20,445.80 million in 2023 and is projected to reach US$ 41,029.45 million by 2031; it is anticipated to record a CAGR of 9.1% from 2023 to 2031. The report includes growth prospects owing to the current heavy commercial vehicle clutch market trends and their foreseeable impact during the forecast period.

Governments of different countries continue to take various initiatives to improve and develop infrastructure, which leads to an increase in demand for heavy-duty vehicles. For instance, the Government of India introduced a scheme to provide affordable housing to all in 2015; through this scheme, ~10 million housing units were built between 2019 and 2024. In 2016, the government of Saudi Arabia announced the Saudi Arabia 2030 scheme and invested approximately US$ 1.3 trillion in 2024 for the development of residential, commercial, and public infrastructure development. In November 2024, the UAE government announced the Dubai Exhibition Center expansion project plan worth US$ 2.7 billion. The project will be completed in three different phases; the first phase includes the expansion of its current 58,000 square meters to 140,000 square meters, which will be completed by 2026. The second phase involves the expansion of the exhibition phase to ~160,000 square meters, along with the development of multi-story parking and road infrastructure by 2028. The final phase includes the expansion of the space to 180,000 square meters for 26 halls and more than 300 hotel, retail, and commercial office facilities. In August 2024, the Government of India announced US$ 494 million for the development of hydropower projects in the northeastern part of the country to reach 15,000 MW of capacity in the coming 8 years. In addition, the government announced the construction of approximately 1,000 bridges across Assam by 2026. This project is expected to require ~US$ 50 million in funding. Thus, growing investments in infrastructure development by governments of different countries across the globe are projected to create lucrative opportunities for heavy commercial vehicle clutch manufacturers during the forecast period. A shortage in the construction workforce is another factor driving the demand for heavy machinery and vehicles in the Middle East and Africa. Moreover, as per the data published by Worldwide Recruitment, a workforce solution provider company, in 2023, the construction industry in the US experienced a 650,000 workers shortage. The availability of a limited workforce across the globe is supporting the demand for commercial vehicles such as concrete trucks, dump trucks, and other heavy construction machinery.

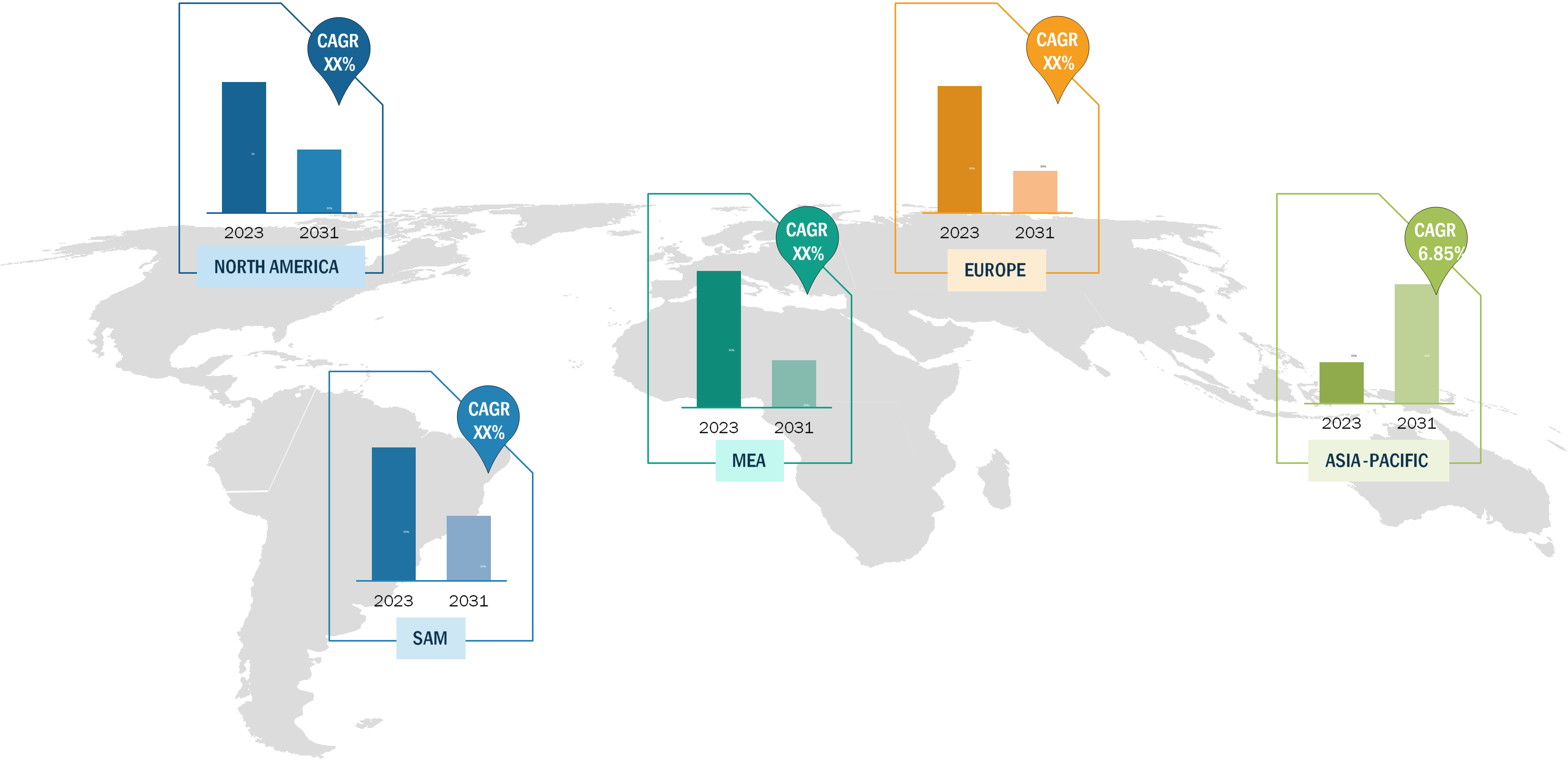

Heavy Commercial Vehicle Clutch Market Size — by Region, 2023

Heavy Commercial Vehicle Clutch Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Distribution Channel (OEM and Aftermarket), Product (Single Plate Clutches, Multi-Plate Clutches, Diaphragm Spring Clutches, Centrifugal Clutches, and Hydraulic Clutches), Vehicle Type (Bus, Truck, Construction Equipment, and Tractors), and Geography

Heavy Commercial Vehicle Clutch Market Forecast by 2031

Download Free Sample

Source: The Insight Partners Analysis

The geographic scope of the heavy commercial vehicle clutch market report offers a detailed country analysis. North America, Europe, and Asia Pacific are major regions witnessing significant growth in the heavy commercial vehicle clutch market. Europe holds a significant heavy commercial vehicle clutch market share. The region has well-established manufacturing facilities, including automotive, aerospace, machinery, mining, and construction. These industries need heavy commercial vehicles for the transportation and shipping of heavy machines, vehicles, automotive parts, construction equipment, and other materials. In addition, the rise in investment toward the development of public infrastructure in the region is anticipated to fuel the heavy commercial vehicle clutch market growth in the coming years owing to the rise in demand for heavy commercial vehicles in the applications, including towing, moving, hauling, and delivery/transport, among others. In addition, investments in power grids increased by 20% in the European Union and reached US$ 65 billion in 2023, and oil and gas investments reached US$ 30 billion, fueling the demand for heavy commercial vehicles in the transportation of heavy machines such as electrical machines and equipment such as generators, arrestors, transformers, power lines, and other heavy electrical machines. Such a rise in investment toward public infrastructure development is anticipated to fuel the market growth from 2023 to 2031. The construction sector experienced a decline in Germany in the past few years. As per the data published by the European Construction Industry Federation, 2023 was the third year that recorded a drop in the overall construction industry in Germany. The rising population, demographic changes, and a positive economic outlook are the major driving factors for the rising demand for residential, commercial, and industrial buildings. In addition, according to the International Council on Clean Transportation (ICCT), Germany was among the largest European markets for heavy-duty vehicle sales, with a heavy commercial vehicle clutch market share of 28.4% in the second quarter of 2024. In addition, government initiatives toward waste collection and waste management, such as the Circular Economy Act 2012, are expected to fuel the demand for dump and garbage trucks, which, in turn, is anticipated to propel the market growth during the forecast period.

In 2024, the German Federal Government announced its plan to initiate a few major transportation infrastructure projects, which include the Stuttgart 21 Railway Project, The Frankfurt Airport Terminal 3, Fehmarnbelt Fixed Link, and Energy Transition and Green Infrastructure. As a result, the rise in construction activities and infrastructure development projects resulted in growing sales of commercial vehicles in Germany in 2023. Commercial vehicle sales increased from 0.31 million units in 2022 to 0.36 million units in 2023, as per the OICA. Such an increase in commercial vehicle sales in Germany is anticipated to fuel the demand for heavy commercial vehicle clutches, which, in turn, is expected to fuel the market growth in the coming years. Italy invested in developing infrastructure for its energy sector in the past few years to reduce the dependency on other European nations. For instance, in 2022, Capital Dynamics and EOS initiated the construction of the largest solar project in Italy. Apart from the investments in the energy infrastructure, the country set a record for the largest construction projects in 2022. These projects included the construction of new railway networks, roads and highway infrastructures, and racing track construction. As per the data published by the National Association of Building Contractors (ANCE), the investments in the Italy construction sector witnessed an increase of 17% in 2022 from US$ 185 billion in 2021. This trend continued in 2023 to reach a total investment of US$ 241 billion. This growth is primarily witnessed in nonresidential and public infrastructure sectors. Such an increase in investments is projected to create lucrative demand for heavy-duty trucks and construction machinery, which, in turn, is contributing to the growing heavy commercial vehicle clutch market size in the country during the forecast period.

AISIN Group; Magneti Marelli; Schaeffler Group; ZF Friedrichshafen; BorgWarner, Inc.; Valeo SA; Eaton Corporation; EXEDY Corporation; and F.C.C. Co., Ltd. are among the key players profiled in the heavy commercial vehicle clutch market report. Companies operating in the heavy commercial vehicle clutch market mainly focus on product and service enhancements by integrating advanced features and technologies into their offerings.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com