$4450

$3560

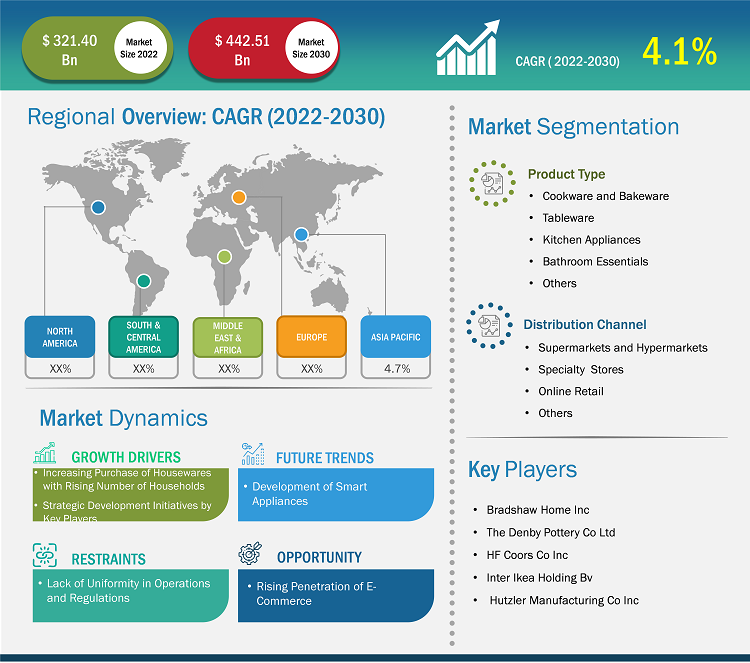

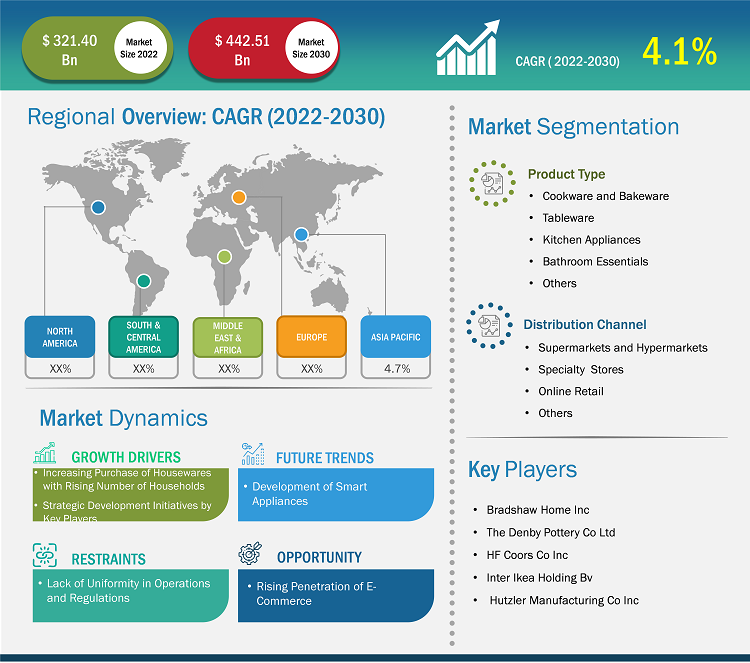

[Research Report] The housewares market size was valued at US$ 321.40 billion in 2022 and is expected to reach US$ 442.51 billion by 2030; it is estimated to register a CAGR of 4.1% from 2022 to 2030.

Market Insights and Analyst View:

Housewares are products and items used within a household for cooking, baking, and home organization, among other purposes. The housewares market has been growing steadily due to factors such as changing lifestyles and more time spent at home, which have triggered the demand for functional and aesthetically pleasing housewares. During the COVID-19 pandemic, people spent more time at home and invested in improving their living spaces. Additionally, a rise of e-commerce and online shopping platforms has made it easier for consumers to access and buy a wide range of houseware products from their homes. These factors, coupled with innovative designs and sustainable options made available by houseware companies favor the expansion of the housewares market.

Growth Drivers and Challenges:

Dynamic changes in lifestyle and the rising dual-income families led to an upsurge in disposable incomes and improved living standards of households. With increasing disposable incomes, consumers spend significant amounts on housewares and other appliances supporting convenient living. They are often willing to purchase new products owing to their unique styles, which appeal to their individuality, resulting in a higher buying frequency. Moreover, a burgeoning number of single-person households triggers the need for home modifications, thereby driving the demand for housewares such as kitchen appliances, cookware, bakeware, tableware, and bathroom essentials.

Further, a rise in urbanization has been bolstering the demand for residential units and, ultimately, homewares products. As per the US Census Bureau and the US Department of Housing and Urban Development, the US completed construction of ~1,3 million housing units in 2021, whereas construction of ~1,7 million housing units was in progress. Similarly, rising urbanization in European countries has created a huge demand for residential housing. According to the European Commission, residential building permits increased by 42.3% from 2015 to 2021 in the European Union. In 2021, France, Germany, and Poland accounted for the most commencements of residential construction in Europe. Thus, the increasing construction of housing units across various countries further boosts the demand for housewares. Thus, the increasing purchase of housewares along with the rising number of households propels the housewares market growth.

However, the housewares market is highly fragmented and disorganized due to many untapped small private enterprises and street vendors operating in developing countries. According to an article published in Business Standards, as of 2020, 80% of the kitchenware market was unorganized in India. Local small businesses use low-quality raw materials to manufacture housewares such as cookware, bakeware, bathroom accessories, and tableware. The usage of low-quality raw materials results in poor-quality end products that are prone to damage. Also, manufacturers offer these products at low costs; therefore, the majority of consumers buy these products due to affordability and easy availability. This factor results in the shrinkage of the customer base of major houseware manufacturers.

Further, more often, local manufacturers in the unorganized housewares market do not comply with the regulatory standards, which can raise quality issues and hamper the perception of consumers toward houseware products. Further, the availability of counterfeit products can hamper the brand image of key players. Thus, the lack of uniformity in operations and regulations hampers the growth of the housewares market.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Housewares Market: Strategic Insights

Market Size Value in US$ 321.40 billion in 2022 Market Size Value by US$ 442.51 billion by 2030 Growth rate CAGR of 4.1% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Housewares Market: Strategic Insights

| Market Size Value in | US$ 321.40 billion in 2022 |

| Market Size Value by | US$ 442.51 billion by 2030 |

| Growth rate | CAGR of 4.1% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Report Segmentation and Scope:

The global housewares market is segmented on the basis of product type, distribution channel, and geography. Based on product type, the market is categorized into cookware and bakeware, tableware, kitchen appliances, bathroom essentials, and others. By distribution channel, the market is categorized into supermarkets and hypermarkets, specialty stores, online retail, and others. By geography, the global housewares market is broadly segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America.

Segmental Analysis:

Based on product type, the housewares market is categorized into cookware and bakeware, tableware, kitchen appliances, bathroom essentials, and others. The tableware segment is expected to register the highest CAGR during 2022–2030. The tableware segment includes products such as crockery, cutlery, glassware, and serveware. A surge in demand for tableware in the housewares market can be attributed to transformed dining habits during the COVID-19 pandemic. With more people dining at home, people have started focusing on aesthetic and functional tableware, as it enhances home dining experiences. From everyday meals to special gatherings, consumers are looking for tableware sets that elevate their dining experience. Furthermore, the growing appreciation for unique and artisanal designs plays a significant role in driving the demand for tableware. Consumers are increasingly drawn to handcrafted and artistically inspired tableware pieces that bring a touch of individuality and personality to their dining settings. Thus, a shift toward more personalized and visually striking tableware choices has contributed to the progress of the housewares market for the tableware segment. Vivo - Villeroy & Boch Group, Corelle, Pyrex, Luminarc, and Schott Zwiesel are a few of the prominent players operating in the market for tableware.

Regional Analysis:

The housewares market is segmented into five key regions: North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. Asia Pacific dominated the global housewares market in 2022 as the market in this region was valued at US$ 120.63 billion in that year. Europe is a second major contributor, holding more than 23% share of the global market. Asia Pacific is expected to register a considerable CAGR of over 5% during 2022–2030. The growing urbanization and disposable income of the middle-class population is a prime factor propelling the demand for modern and convenient housewares, including advanced kitchen appliances and stylish tableware.

Housewares Market Report Scope

COVID-19 Pandemic Impact:

The COVID-19 pandemic initially hindered the global housewares market due to the shutdown of manufacturing units, shortage of labor, disruption of supply chains, and financial instability. The disruption of operations in various industries due to the economic slowdown caused by the COVID-19 outbreak restrained the housewares supply. Moreover, various stores were closed, which limited the sales of housewares. Nevertheless, businesses started gaining ground as previously imposed limitations were revoked across various countries in 2021. Moreover, the implementation of COVID-19 vaccination drives by governments of different countries eased the situation, leading to a rise in business activities worldwide. Several markets, including the housewares market, reported growth after the ease of lockdowns and movement restrictions.

Competitive Landscape and Key Companies:

Bradshaw Home Inc, Denby Pottery, HF Coors Co Inc, Inter Ikea Holding Bv, Hutzler Manufacturing Co Inc, TTK Prestige Ltd, Newell Brands Inc, BSH Hausgerate GmbH, Kohler Co, and Haier US Appliance Solutions Inc are among the prominent players operating in the global housewares market.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, and Distribution Channel

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Based on distribution channel, the housewares market is segmented into supermarkets and hypermarkets, specialty stores, online retail, and others. Buying convenience and accessibility are the significant characteristics of supermarkets and hypermarkets. These stores are typically located in areas that are easily accessible by the masses, making it convenient for customers to check and purchase housewares alongside completing the planned shopping. Many supermarkets and hypermarkets have introduced their private label houseware brands, offering consumers superior-quality products at competitive prices. Supermarkets and hypermarkets have extended operating hours, which allows customers to shop at convenient hours. Also, these larger retail establishments often have the advantage of bulk purchasing power, which allows them to offer products at competitive prices. Moreover, supermarkets and hypermarkets tend to stock a variety of houseware in different product types, brands, and varieties, providing customers with a more elaborate range of selections. Walmart, Costco Wholesale Corporation, Tesco, Target, and Bed Bath & Beyond are some of the supermarkets and hypermarket stores offering houseware products.

The major players operating in the global housewares market are Bradshaw Home Inc, Denby Pottery, HF Coors Co Inc, Inter Ikea Holding Bv, Hutzler Manufacturing Co Inc, TTK Prestige Ltd, Newell Brands Inc, BSH Hausgerate GmbH, Kohler Co, and Haier US Appliance Solutions Inc among others.

Dynamic changes in lifestyle and the rising dual income families led to an upsurge in disposable incomes and improved living standards of households. With increasing disposable incomes, consumers spend significant amounts on housewares and other appliances supporting convenient living. They are often willing to purchase new products owing to their unique styles, which appeal to their individuality, resulting in a higher buying frequency. Moreover, a burgeoning number of single-person households triggers the need for home modifications, thereby driving the demand for housewares such as kitchen appliances, cookware, bakeware, tableware, and bathroom essentials. Further, a rise in urbanization has been bolstering the demand for residential units and, ultimately, homewares products. As per the US Census Bureau and the US Department of Housing and Urban Development, the US completed construction of ~1,337,800 housing units in 2021, whereas construction of 1,702,000 housing units was in progress. Similarly, rising urbanization in European countries has created a huge demand for residential housing. For instance, according to the European Commission, between 2015 to 2021, residential building permits increased by 42.3%. In 2021, France, Germany, and Poland had the most residential construction starts in Europe. Thus, the increasing construction of housing units across various countries further boosts the demand for housewares.

Smart appliances can be operated using smartphones or tablets connected via Bluetooth, near–field communication (NFC), or Wi-Fi. These technologies allow users to control their smart appliances via an app. Manufacturers are continuously modifying and developing smart home appliances to support easy lifestyles, which especially appeals to tech-savvy consumers. Well-known brands have been developing devices with automation and hi-tech features for smart homes. Moreover, voice assistants and artificial intelligence (AI) are bringing significant evolution into smart housewares.

Energy-saving appliances, notifications enabled on connected devices, and Wi-Fi capabilities are the key functional upgrades in smart kitchen appliances. For example, smart microwaves can seamlessly download cooking instructions, read barcodes on food products, and offer AI voice assistants to enable a completely hands-free experience. Whirlpool, in January 2022, announced that some of its smart, Wi-Fi-connected microwave would be upgraded to incorporate an air fry mode via a software update to replicate the crispy reheating specifications. Thus, the incorporation of innovative technologies into housewares is likely to bring new trends in the housewares market in the coming years.

Based on product type, the housewares market is categorized into cookware and bakeware, tableware, kitchen appliances, bathroom essentials, and others. The tableware segment is expected to register the highest CAGR during 2022–2030. The tableware segment includes products such as crockery, cutlery, glassware, and serveware. A surge in demand for tableware in the housewares market can be attributed to transformed dining habits during the COVID-19 pandemic. With more people dining at home, people have started focusing on aesthetic and functional tableware, as it enhances home dining experiences. From everyday meals to special gatherings, consumers are looking for tableware sets that elevate their dining experience. Furthermore, the growing appreciation for unique and artisanal designs plays a significant role in driving the demand for tableware. Consumers are increasingly drawn to handcrafted and artistically inspired tableware pieces that bring a touch of individuality and personality to their dining settings. Thus, a shift toward more personalized and visually striking tableware choices has contributed to the progress of the housewares market for the tableware segment. Vivo - Villeroy & Boch Group, Corelle, Pyrex, Luminarc, and Schott Zwiesel are a few of the prominent players operating in the market for tableware.

The List of Companies - Houseware Market

- Bradshaw Home Inc

- The Denby Pottery Co Ltd

- HF Coors Co Inc

- Inter Ikea Holding Bv

- Hutzler Manufacturing Co Inc

- TTK Prestige Ltd, Newell Brands Inc

- BSH Hausgerate Gmbh

- Kohler Co

- Haier US Appliance Solutions Inc.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Housewares Market

Oct 2023

Household Fans Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Ceiling Fan, Pedestal Fan, Table Fan, Exhaust Fan, Wall Fan, and Others), Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online Retail, and Others), and Geography

Oct 2023

Nutraceuticals Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type [Functional Foods, Functional Beverages, and Dietary Supplements [General Wellness, Sports Nutrition, Weight Management, Immune Health, and Others)], Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online Retail, Convenience Stores, and Others), and Geography

Oct 2023

Nicotine Pouches Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis By Strength (Less than 6 mg/g, 6 mg/g to 12 mg/g, and More than 12 mg/g), Flavor [Original/Plain, and Flavored (Mint, Berry, Citrus, Fruity, Others)], Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Retail, and Others)

Oct 2023

Housewares Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Product Type (Cookware and Bakeware, Tableware, Kitchen Appliances, Bathroom Essentials, and Others) and Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online Retail, and Others)

Oct 2023

False Hair Products Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Product Type (Hair Extension, Hair Wig, and Hair Pieces), Material (Human Hair and Synthetic Hair), End User (Men, Women, and Kids), and Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online Retail, and Others)