$4450

$3560

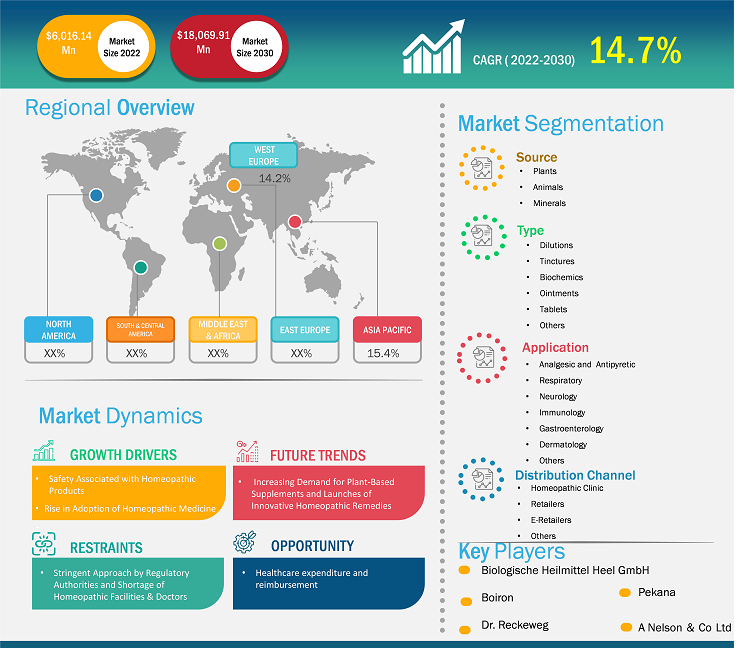

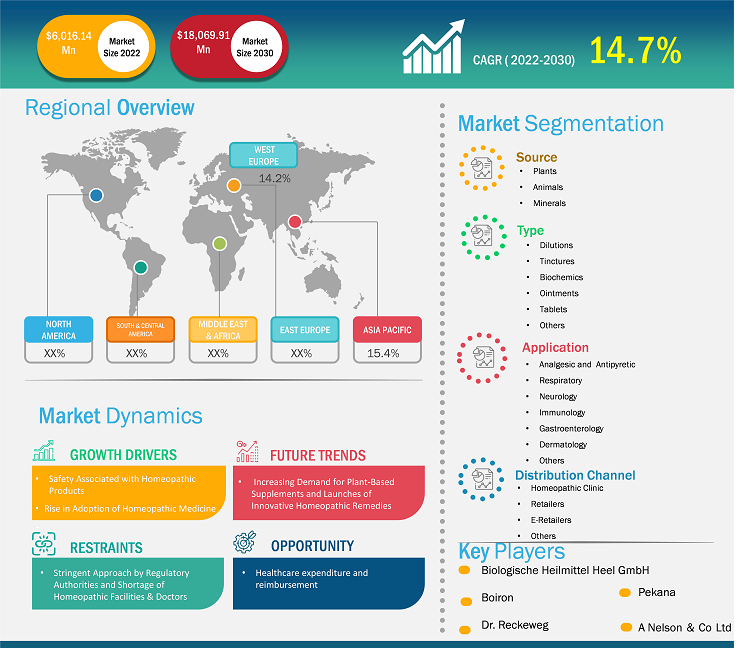

[Research Report] The homeopathy market is expected to reach US$ 18,069.91 million by 2030 from US$ 6,016.14 million in 2022. The market is estimated to grow with a CAGR of 14.7% from 2022 to 2030.

Market Insights and Analyst View:

Homeopathy is an alternative form of medicine that uses highly diluted substances to stimulate the body’s natural healing abilities. Several factors contribute to the growth of homeopathy market. The prevalence of chronic diseases and lifestyle related health problems has been on the rise and homeopathy is often sought for managing chronic conditions and improving overall well-being. Increased awareness of homeopathy and its potential benefits, along with growing acceptance among healthcare professionals, have contributed to its wider adoption. Homeopathic products are primarily sourced from plants (such as red onion, arnica [mountain herb], poison ivy, belladonna [deadly nightshade], and stinging nettle), minerals (such as white arsenic), or animals (such as crushed whole bees). Homeopathic products are often made as sugar pellets to be placed under the tongue; they may also be in other forms, such as ointments, gels, drops, creams, and tablets. Treatments are “individualized” or can be customized as per the requirements from consumers.

Growth Drivers and Challenges:

There are growing concerns about the potential side effects of allopathic pharmaceutical drugs or regular medication. In Asian and European countries, consumers have been turning to alternative medicines, such as natural remedies, homeopathy, and herbal medicines. Some skilled homeopaths have also been promoting the benefits of alternative medicines, especially to patients suffering from chronic health conditions such as cardiovascular disease and cancer. A study published in the Scandinavian Journal of Public Health in 2017 stated that alternative practices are primarily used in a complementary manner or in combination with traditional medicine. For instance, Curcuma longa (turmeric), a traditional form of medicine that originates from India, is one of the natural ingredients that is steeped in homeopathy. These conventional or alternative types of medicines are gaining popularity in Europe, and the trend is benefitting natural ingredient suppliers in developing countries.

According to Homeo Book, over the past 30–40 years, homeopathy has benefited from the growing demand from doctors and consumers in the majority of European countries. A survey by the European Commission states 3 out of 4 Europeans know about homeopathy, and ~60% of those who are aware use it in their healthcare. In the European Union, more than 30,000 physicians have taken training course in homeopathy. In addition, ~46–47% of general practitioners (GPs) in Europe prescribe homeopathic medicines without any homeopathic training on a time-to-time basis, while 6–8% GPs prescribe those on a more regular basis.

The preference for orally administered medications and drugs without any side effects has been on the rise for a long, and it would continue to grow in the coming years. Allopathy contains strong medications; however, they are not appropriate for everyone. Furthermore, allopathic drugs are expensive and only have a transient effect on illnesses. Moreover, despite the completion of the course of prescribed drugs, the illness can resurface. Cases of drug abuse are more common with allopathic medicines, which is another factor for the shifting focus toward natural medications. Homeopathy remedies, on the other hand, are inexpensive and exhibit no or negligible side effects. Thus, the increasing adoption of homeopathic medicine bolsters the homeopathy market growth.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Homeopathy Market: Strategic Insights

Market Size Value in US$ 6,016.14 million in 2022 Market Size Value by US$ 18,069.91 million by 2030 Growth rate CAGR of 14.7% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Homeopathy Market: Strategic Insights

| Market Size Value in | US$ 6,016.14 million in 2022 |

| Market Size Value by | US$ 18,069.91 million by 2030 |

| Growth rate | CAGR of 14.7% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Report Segmentation and Scope:

The “Global Homeopathy Market” is segmented based on source, type, application, distribution channel, and geography. Based on source, the homeopathy market is segmented into plants, animals, and minerals. The plants segment held the largest share in 2022. Based on application, the global homeopathy market is segmented into analgesic and antipyretic, respiratory, neurology, immunology, gastroenterology, dermatology, and others. The immunology segment held the largest share of the market in 2022 and the immunology segment is anticipated to register the highest CAGR in the market during the forecast period. Based on distribution channel, the homeopathy market is segmented into homeopathic clinics, retail pharmacies, e-retailers, and others. The homeopathic clinics segment held the largest share of the market in 2022 and the same segment is anticipated to register the highest CAGR during the forecast period. The global homeopathy market based on geography is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and Rest of the Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of the Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and Rest of the Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Segmental Analysis:

Based on type, the homeopathy market is segmented into dilutions, tinctures, biochemics, ointments, tablets, and others. The dilutions segment held the largest market share in 2022. However, the ointments segment is anticipated to register the highest CAGR of 15.4% during the forecast period. Homeopathic medicines are obtained from a controlled process of successive homeopathic dilutions. They are prepared by crushing a plant, animal, or mineral substance. The extract is diluted in a mixture of alcohol and water. Insoluble solids are diluted by grinding them with lactose. The process is repeated several times to achieve a therapeutic dilution. After each dilution, the mixture is vigorously agitated; this process is called succussion. The process of succussion assures the therapeutic effect of the drug. The rising awareness regarding the efficiency of alternative medical practices, especially in treating chronic diseases, is the key factor bolstering the demand for homeopathy dilution products worldwide. Moreover, demand is growing in emerging countries due to rising belief in the efficacy of homeopathy dilutions. Furthermore, the rising prevalence of lifestyle diseases supports the homeopathy market growth for homeopathy dilutions.

Based on distribution channel, the homeopathy market is segmented into homeopathic clinics, retail pharmacies, e-retailers, and others. The homeopathic clinics segment held the largest share of the market in 2022 and the same segment is anticipated to register the highest CAGR of 15.2% in the market during the forecast period. The gradual shift of patients from hospitals to clinics due to cost considerations and personalized care is likely to drive the growth of the homeopathy market for the clinics segment. In addition, the presence of a large number of homeopathic clinics is aiding the growth of the market for this segment. For example, Star Homeopathy has 40 branches across India. Dr Batra's has 63 clinics in 16 cities in India that offer homeopathy treatment. The clinic has 10 international clinics in 5 countries. In April 2019, it launched its first clinic in Abu Dhabi to cater the growing demand for homeopathy in the Gulf region. Further, in November 2022, Namma Homeopathy Clinic gained popularity in Maharashtra and Karnataka due to its effective treatment services. The homeopathy clinic stands tall with a total of 20 branches across Maharashtra and Karnataka, employing 200+ highly experienced and qualified doctors, who have successfully treated more than 100,000 acute and chronic diseases. The Namma Homeopathy Clinic in Dadar, Mumbai, is one of the biggest homeopathic corporate branches in Asia.

Regional Analysis:

Based on geography, the homeopathy market is segmented into five key regions: North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. North America homeopathy market has been analysed based on three major countries — the US, Canada, and Mexico. The US homeopathy market is estimated to hold the largest homeopathy market share during the forecast period. The homeopathy market growth in the US has gained awareness owing to rising consumer awareness and interest in homeopathic remedies. Consumers are actively seeking alternative healthcare options and are more willing to explore homeopathic treatment contributing to the market’s expansion. According to the National Library of Medicine, homeopathy is used by just over 2% of the US population, predominantly for respiratory, otorhinolaryngology, and musculoskeletal complaints. Consumers in the United States who see a homeopathic provider for care are more likely to perceive the therapy as helpful than those who do not. Approximately, only 19% of users in the United States see a homeopathic healthcare provider. Homeopathic medicines are active micro-doses of mineral, botanical, and biological substances that treat various acute health conditions, including allergies, coughs, colds, flu, muscle pain, and stress. The increasing burden of influenza in the US is expected to increase homeopathy medicine adoption during the forecast period. As per the Centers for Disease Control and Prevention (CDC), during 2019–2020, an estimated 38 million people fell ill due to flu. Also, increasing awareness of allopathic medicine side-effects after prolonged use is consequently aiding the growth of the homeopathy market. Homeopathic medicines have been regulated as drugs by the US Food and Drug Administration (FDA) and are manufactured in strict accordance with the Homeopathic Pharmacopoeia of the United States (HPUS) and pharmaceutical Good Manufacturing Practices (GMP). In Canada, Health Canada regulates homeopathic products under natural health products category. In Canada, homeopathic medicines fall under the definition of an NHP and are specifically referenced within the Natural Health Products Regulations. These products are reviewed and evaluated to verify safety and health claims. The claims made by the homeopathy medicines are supported by textbooks and other references used in the practice of homeopathy. To identify homeopathy medicine in-store, Health Canada provides an authorization number. This product has an eight-digit number preceded by one of these, "DIN-HM," which indicates a homeopathic product. Health Canada approved more than 8,500 homeopathic products. According to Canada Institute for Health Information, in 2021, Canada's total health expenditure was expected to reach US$ 0.38 million. Overall, it is anticipated that health spending represented 12.8% of Canada's gross domestic product (GDP). According to the University of British Columbia, rising expenditure is anticipated to result in more Canadians choosing preventative care as well as Complementary and Alternative Medicine (CAM) therapies like homeopathy. The growing prevalence of chronic diseases is likely to accelerate the homeopathy medicine market growth during the forecast period. According to a study published by the WHO, an estimated 28,026 new breast cancer cases were diagnosed in Canada in 2020. According to the same study, nearly 29,972 prostate cancer cases were newly diagnosed in the country, which accounted for 10.9% of all cancer cases diagnosed during 2020. Such a high rise in cancer cases is boosting the demand in the country. Homeopathy medicines have shown a positive effect in post-chemotherapy side effects in boosting immunity.

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the global homeopathy market are listed below:

- In May 2022, Hyland’s Naturals unveiled a new brand campaign, including a new identity, logo, website, and national media launch reflecting the growth of the company's consumer health products portfolio and a redefined strategy focused on the vitamins, minerals, and supplements category. Hyland’s Naturals’ new look and feel represents a commitment to innovation and the company's purpose of keeping families healthy.

- In January 2020, PEKANA NATURHEILMITTEL GmbH joined hands with ADELMAR PHARMA GmbH to manufacture Homoeopathic Medicines. Their comprehensive line of highly effective remedies has been developed to help practitioners successfully treat acute and chronic illnesses while avoiding the detrimental side effects often accompanying allopathic drug use.

Covid-19 Impact:

With the focus on strengthening the immune system during the pandemic, there was an increased demand for the homeopathic remedies to support overall immune health. Like many industries, homeopathy market faced challenges due to supply chain disruptions which could have impacted the availability of certain products. Some countries granted temporary regulatory flexibility to ensure the availability of homeopathic remedies during the pandemic. Thus, COVID-19 pandemic resulted in increasing demand of homeopathy and make appropriate use of those products in healthcare settings boosting the global homeopathy market in the forecasted period.

Homeopathy Market Report Scope

Competitive Landscape and Key Companies:

Some of the prominent players operating in the global homeopathy market are Fourrts, Allen Healthcare Co. Ltd; Hahnemann Laboratories, Inc; Boiron, Homeocan Inc; Hyland's, Inc.; Nelson Pharmacies Limited, Weleda UK, Biologische Heilmittel Heel GmbH; Ainsworths (London) Limited; DHU-Arzneimittel GmbH & Co. KG; Dr Reckeweg & Co GmbH, Similasan Corp; PEKANA Naturheilmittel GmbH among others. These companies focus on various growth strategies such as collaboration, product launches, business expansions, agreements among others to retain its position in the global market. They have a widespread global presence, which provides them to serve a large set of customers and subsequently increases their homeopathy market share.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Source, Type, Application, Distribution Channel, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Homeopathy is an alternative form of medicine that uses highly diluted substances to stimulate the body’s natural healing abilities. Several factors contribute to the growth of homeopathy market. The prevalence of chronic diseases and lifestyle related health problems has been on the rise and homeopathy is often sought for managing chronic conditions and improving overall well-being. Increased awareness of homeopathy and its potential benefits, along with growing acceptance among healthcare professionals, have contributed to its wider adoption. Homeopathic products are primarily sourced from plants (such as red onion, arnica [mountain herb], poison ivy, belladonna [deadly nightshade], and stinging nettle), minerals (such as white arsenic), or animals (such as crushed whole bees). Homeopathic products are often made as sugar pellets to be placed under the tongue; they may also be in other forms, such as ointments, gels, drops, creams, and tablets. Treatments are “individualized” or can be customized as per the requirements from consumers.

Factors such as safety associated with homeopathic products and rise in adoption of homeopathic medicine are the key drivers aiding the growth of the homeopathy market.

Fourrts, Allen Healthcare Co. Ltd; Hahnemann Laboratories, Inc; Boiron, Homeocan Inc; Hyland's, Inc.; Nelson Pharmacies Limited, Weleda UK, Biologische Heilmittel Heel GmbH; Ainsworths (London) Limited, DHU-Arzneimittel GmbH & Co. KG; Dr Reckeweg & Co GmbH, Similasan Corp; PEKANA Naturheilmittel GmbH; among others are among the leading companies operating in the homeopathy market.

Based on source type, the plants segment held the largest market share in 2022, and the same segment is anticipated to register the highest CAGR of 14.9% during the forecast period.

The homeopathic clinics segment held the largest share of the market in 2022 and the same segment is anticipated to register the highest CAGR of 15.2% in the market during the forecast period.

The List of Companies - Homeopathy Market

- Fourrts

- Allen Healthcare Co. Ltd

- Hahnemann Laboratories, Inc

- Boiron, Homeocan Inc

- Hyland's, Inc.

- Nelson Pharmacies Limited

- Weleda UK

- Biologische Heilmittel Heel GmbH

- Ainsworths (London) Limited

- DHU-Arzneimittel GmbH & Co. KG

- Dr Reckeweg & Co GmbH

- Similasan Corp

- PEKANA Naturheilmittel GmbH

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Homeopathy Market

Aug 2023

Pediatric Cardiology Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Transcatheter Heart Valves, Occlusion Devices, Catheters, Stents, Introducer Sheaths, and Others), Disease Indication (Congenital Heart Disease, Acquired Heart Disease, Arrhythmias, Cardiomyopathies, and Others), Surgical Procedure (Interventional Procedures, Heart Rhythm Management Procedures, and Others), End User (Hospitals, Specialty Clinics, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Aug 2023

Pharmaceutical Membrane Filters Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technology (Microfiltration, Ultrafiltration, Reverse Osmosis and Nanofiltration), Design (Hollow Fiber, Spiral Wound, Tubular System and Plate and Frame), Material (Polyethersulfone (PES), Polysulfone (PS), Cellulose-Based Membranes, Polytetrafluoroethylene (PTFE), Polyvinyl Chloride (PVC), Polyacrylonitrile (PAN) and Others), End User (Pharmaceutical and Biotech Industries and CROs and CDMOs), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, South & Central America)

Aug 2023

ECG Devices Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Resting ECG and Stress ECG), Lead Type (12-Lead ECG, 3–6 Lead ECG, and Single Lead), Technology [Portable (Wired) ECG System and Wireless ECG System], End User (Hospital and Clinics, Ambulatory Surgical Centers, Cardiac Centers, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Aug 2023

Surgical Laser Fiber Units Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Laser Type (CO2 Laser, Diode Laser, Erbium Laser, Nd:YAG Laser, Holmium Laser, Alexandrite Laser, and Others), Material (Silica-Based Fibers, Quartz Fibers, Polymer-Based Fibers, Multimode Fibers, and Others), Power (Low-Power Lasers, Medium-Power Lasers, and High-Power Lasers), Application (Urology, Dermatology, Gynecology, Cardiology, Neurology, Ophthalmology, Respiratory, Dentistry and Others), Wavelength (9,301 nm and above, 2,941–9,300 nm, and 1,441–2,940 nm, 821–1,440 nm, 710–820 nm, and below 710 nm), End User (Hospitals, Specialty Clinics, Physician Office, and Others), and Geography

Aug 2023

Therapeutic Vaccines Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Cancer Vaccines, Infectious Disease Vaccines, and Others), Technology (Allogenic Vaccines and Autologous Vaccines), End User (Hospitals, Clinics, and Others), and Geography

Aug 2023

Medical Cables Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Disposable Medical Cables, Reusable Medical Cables, and Custom Medical Cables), Applications [Diagnostics (Ultrasound Cables, Endoscopy Cables, Patient Interface Cables, and Others), Motorized Equipment, Patient Monitoring (ECG Cables, SpO2 Cables, NiBP Cables, EEG Cables, and Others), Surgical and Life Support (Fiber Optics, Modular Local Area Network, and Others), and Others], End User (Hospital and Clinics, Diagnostic Laboratories and Imaging Centers, Ambulatory Surgical Centers, and Others), and Geography

Aug 2023

Laser-Assisted ENT Surgeries Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Laser Type (C02 Laser, Nd:YAG Laser, Diode Laser, Blue Laser, KTP Laser, Argon Laser, and Other Laser Types), Surgery Type [Laser Laryngeal Surgery, Laser Endoscopic Sinus Surgery (LESS), Laser-Assisted Uvulopalatoplasty (LAUP), Laser-Assisted Stapedotomy, Laser-Assisted Tonsillectomy and Adenoidectomy, Laser Turbinates Reduction, Transoral Laser Microsurgery (TLM), Nasal Surgery, and Other Surgery Types], End User (Hospitals and Specialty Clinics, Physician Offices, and Other End Users), and Geography (North America, Europe, Asia Pacific, South and Central America, and Middle East and Africa)

Aug 2023

Mobile Cleanroom Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Softwall and Hardwall), End User (Microelectronics Industry, Pharmaceuticals and Biotechnology Industry, Medical Device Manufacturers, and Others), and Geography