$5190

$4152

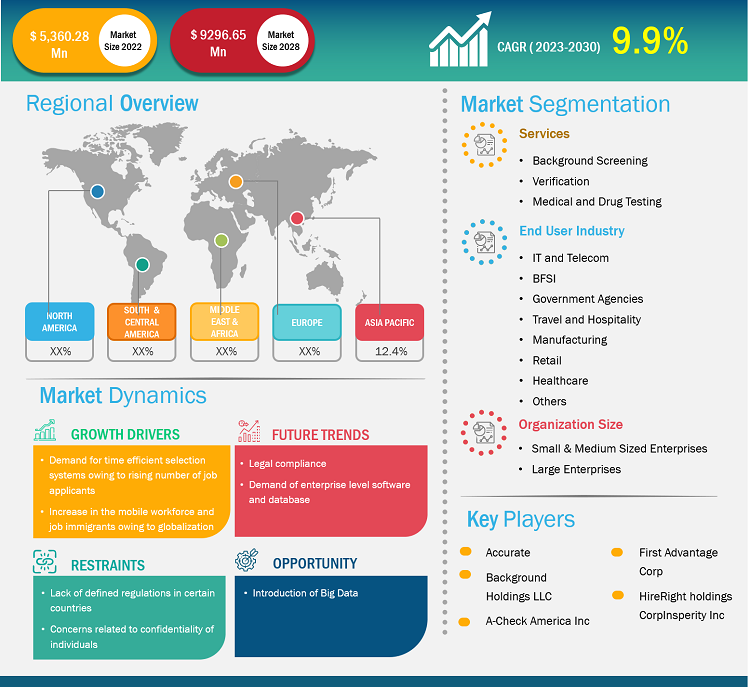

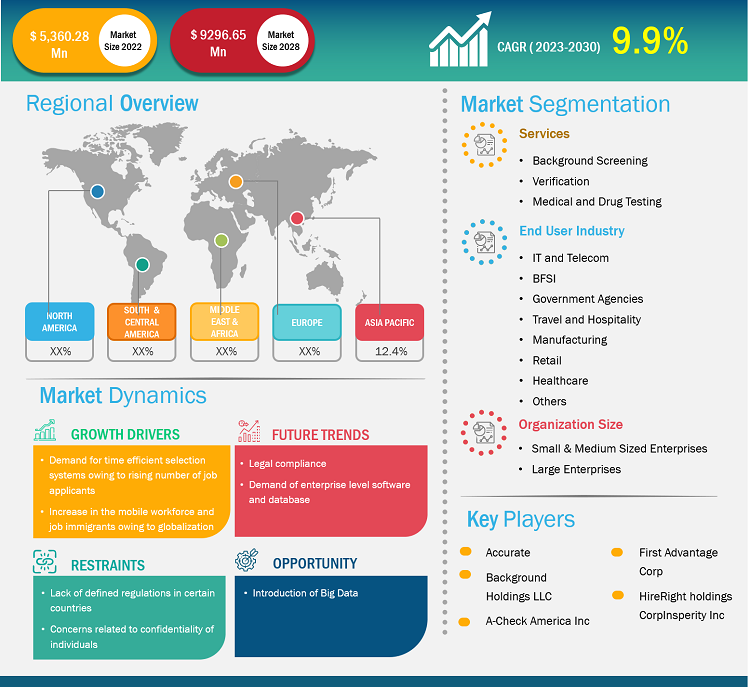

The employment screening services market size is expected to reach US$ 9.88 billion by 2031 from US$ 5.82 billion in 2023. The market is estimated to record a CAGR of 6.8% from 2023 to 2031. The integration of artificial intelligence in screening processes and the rise of continuous screening are expected to become key market trends.

Employment Screening Services Market Analysis

Employment screening services are most commonly used during the recruitment process to ensure potential hires are a good fit for the company in terms of skill, experience, and character. When considering internal candidates for promotions to sensitive or high-responsibility roles, screening can verify if the employee has maintained a clean record. Also, industries such as healthcare, finance, and transportation often require specific checks, including drug testing, credit checks, or license verification, to comply with regulatory standards. Some organizations conduct periodic re-screening of employees to ensure ongoing compliance with company policies or industry regulations. By opting for employment screening services, organizations can save time in the long run as these services offer them clarity on responsibilities that should be taken to ensure the appropriate candidates are hired in the right way, which, in turn, increases work quality and efficiency. The increase in the number of job immigrants and the gig economy and rising employee fraudulent activities are propelling the employment screening services market growth. The rising need to comply with regulatory standards and the introduction of big data are further expected to create new opportunities for the employment screening services market during the forecast period.

Employment Screening Services Market Overview

Employment screening services involve conducting background checks and verifications on potential employees during the hiring process. These services help employers confirm that a candidate's qualifications, history, and personal details align with the requirements of the job and the company's policies. Employment screening services confirm the authenticity of candidates' credentials, employment history, and educational background by conducting extensive background checks. By carefully screening applicants, only legitimate and skilled people are considered for jobs. This method helps identify and eliminate candidates who may have included false material on their resumes. By using these services, previous employers or listed references can be contacted to evaluate the candidate's work performance, reliability, and character. These services can review a candidate's financial history to assess risk, especially for roles in finance or positions of trust. It can screen candidates for illegal substance use, which is often required in safety-sensitive industries.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Employment Screening Services Market: Strategic Insights

Market Size Value in US$ 5.38 billion in 2022 Market Size Value by US$ 12.62 billion by 2030 Growth rate CAGR of 11.2% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Employment Screening Services Market: Strategic Insights

| Market Size Value in | US$ 5.38 billion in 2022 |

| Market Size Value by | US$ 12.62 billion by 2030 |

| Growth rate | CAGR of 11.2% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Employment Screening Services Market Drivers and Opportunities

Increase in Number of Job Immigrants and Gig Economy

The increasing number of job immigrants and the growing gig economy are significantly driving the demand for employment screening services. As workforce dynamics shift globally, companies face unique challenges in verifying backgrounds, ensuring compliance, and mitigating risks. Globalization and economic migration have increased the number of individuals seeking employment in foreign countries. In 2023, the global flow of job immigrants increased, driven by both economic opportunities and labor shortages in high-income nations. For instance, the Congressional Budget Office (CBO) reported that in 2023 and 2024, the US experienced a significant uptick in immigration, with a net influx of 3.3 million people, well above the 1 million projected prior to the pandemic. Also, according to the European Commission, more than 37.7 million foreigners resided within the European Union and EFTA nations as of 2023. This has placed greater pressure on companies to conduct comprehensive background checks to verify international credentials and ensure compliance with local laws. Companies hiring foreign nationals face challenges in verifying qualifications, past employment, and criminal records across different countries. Employment screening services are vital for accessing global databases and validating international records. Employers must adhere to strict immigration and labor laws, such as verifying work visas, permits, and citizenship documentation. Screening services ensure compliance, reducing the risk of penalties or legal issues. As companies hire more H-1B visa holders in tech and other sectors, the demand for screening services has surged. Employers need to verify educational credentials from foreign institutions, ensuring compliance with US Department of Labor standards.

Additionally, the gig economy—characterized by freelance, short-term, or contract-based work—has exploded due to platforms such as Uber, DoorDash, Fiverr, and Upwork. These platforms require a constant requirement of independent workers, creating a growing need for employment screening services to ensure the trustworthiness and qualifications of workers. Various companies rely on gig workers who are using screening services. For instance, Amazon's delivery network, which relies on gig workers for last-mile deliveries, uses background screening to ensure drivers' safety and reliability.

Rising Need to Comply with Regulatory Standards

Companies face increased pressure to meet stringent laws across various sectors. Compliance with these regulations is crucial to avoid legal penalties, maintain operational transparency, and protect against financial and reputational damage. Many industries, such as healthcare, finance, education, and government, are subject to strict regulatory standards regarding background checks. For example, in the US, healthcare providers must comply with the Health Insurance Portability and Accountability Act (HIPAA) and Office of Inspector General (OIG) regulations, which mandate comprehensive background checks to ensure patient safety and prevent hiring individuals excluded from participating in federal health programs. For instance, in April 2023, OIG announced its plans to improve and update existing CPGs and to deliver new compliance program guidance documents (CPGs) specific to segments of the healthcare industry or entities involved in the healthcare industry that have emerged in recent years. Also, the Patriot Act and other anti-money laundering (AML) regulations require financial institutions to conduct thorough background checks on employees to prevent financial crimes such as money laundering and fraud. Compliance with the Financial Industry Regulatory Authority (FINRA) also requires firms to screen employees thoroughly before hiring.

Employment Screening Services Market Report Segmentation Analysis

Key segments that contributed to the derivation of the employment screening services market analysis are services, organization size, and application.

- Based on services, the employment screening services market is segmented into background screening, verification, and medical and drug testing. The verification segment dominated the market in 2023.

- In terms of organization size, the employment screening services market is segmented into small and medium-sized enterprises and large enterprises. The large enterprises segment dominated the market in 2023.

- Based on application, the market is segmented into IT and telecom, BFSI, government agencies, travel and hospitality, manufacturing, retail, healthcare, and others. The IT and telecom segment dominated the market in 2023.

Employment Screening Services Market Share Analysis by Geography

- The employment screening services market is segmented into five major regions: North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. North America dominated the market in 2023, followed by Europe and APAC.

- A global surge in internet users and innovative changes in human resource management have created a rich atmosphere for the propagation of screening services. Many industries are currently stimulated by the candidate-driven employment market, wherein companies are keen to decrease the time-to-hire ratios. Hiring delays impact organizations in terms of time and cost. Companies these days are competing for the best candidates and, therefore, are putting more emphasis on crafting a positive onboarding experience, which also includes the background screening process of employees. Further, an increase in international recruitment has created new opportunities for organizations in different sectors. However, hiring candidates from overseas can lead to crucial legal and logistical difficulties for hiring departments. Organizations with high yearly incomes spend excessive amounts on the employment and onboarding processes. Such companies conduct an exhaustive background screening to deploy best practices in hiring and onboarding programs. Background screening costs much less to companies than the monetary loss incurred by drug abuse or any other crime at the workplace.

Employment Screening Services Market Report Scope

Employment Screening Services Market News and Recent Developments

The employment screening services market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the employment screening services market are listed below:

- Accurate Background, the largest privately held global provider of compliant background checks, drug and health screening, and employment monitoring solutions, announced its plans to release a new mobile-first drug and health screening experience designed to create a better candidate experience.

(Source: Accurate Background, Press Release, April 2024)

- AuthBridge announced a new and improved version of iBRIDGE. iBRIDGE 2.0 is the next-gen background verification platform that will enable companies with seamless candidate onboarding and verification experiences for new-age talent. With this new product launch, clients of AuthBridge will be able to activate candidate verifications in seconds and deep dive into a candidate's documentation status with a single click.

(Source: AuthBridge, Press Release, January 2023)

Employment Screening Services Market Report Coverage and Deliverables

The "Employment Screening Services Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- Employment screening services market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Employment screening services market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Employment screening services market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the employment screening services market

- Detailed company profiles

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Services, Application, Organization Size

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The incremental growth expected to be recorded for the global employment screening services market during the forecast period is US$ 3,937.40 million.

The global employment screening services market is expected to reach US$ 9881.83 million by 2031.

The key players holding majority shares in the global employment screening services market are Hireright Llc; Adp, Inc.; Capita Plc; First Advantage; Paychex Inc; and Automatic Data Processing Inc.

Integration of Artificial Intelligence in screening processes and rise of Continuous Screening, which is anticipated to play a significant role in the global employment screening services market in the coming years.

The global employment screening services market was estimated to be US$ 5821.27 million in 2023 and is expected to grow at a CAGR of 6.8 % during the forecast period 2023 - 2031.

Increase in number of job immigrants and gig economy, rise in employee fraudulent activities, and increase in demand for background checks are the major factors that propel the global employment screening services market.

The List of Companies - Employment Screening Services Market

- Accurate Background Holdings LLC

- AuthBridge Research Services Pvt Ltd

- Capita Plc

- DataFlow LLC

- First Advantage Corp

- HireRight LLC

- Insperity

- Pinkerton Consulting & Investigations Inc

- Triton

- Verity Screening Solutions

- Acuity International

- Reveal Background LLC

- Veremark

- Cisive

- Reed Group

- Paychex Inc

- GoodHire

- ezyHire

- Automatic Data Processing Inc

- KPMG Assurance and Consulting Services LLP

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Employment Screening Services Market

Oct 2024

Flight Planning Software Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Software and Services), Deployment (Cloud and On-Premise), Application (Logistics and Cargo, Airport, Private Airlines, Commercial Airlines, Flight School and Training Center, and Military and Defense), and Geography

Oct 2024

Deepfake AI Detection Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Software and Services), Deployment (Cloud and On-Premises), Enterprise Size (Large Enterprises and SMEs), Industry Vertical (Media and Entertainment, BFSI, Government and Politics, Healthcare and Life Sciences, IT and Telecom, Retail and E-Commerce, and Others), and Geography

Oct 2024

Electronic Patient-Reported Outcomes (ePROS) Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Delivery Mode (Cloud Based and On-Premises), Application (Oncology, Respiratory, and Others), End User [Contract Research Organizations (CROs), Pharmaceutical Companies, and Others], and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Oct 2024

Travel and Expense Management Software Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Deployment Mode (On-Premise and Cloud), Organization Size (Large Enterprises and Small and Medium Enterprises), Industry (BFSI, IT and Telecom, Manufacturing, Healthcare, Government and Defense, Retail, Transport and Logistics, and Others), and Geography

Oct 2024

Environmental Consulting Service Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Service Type (Investment Assessment and Auditing, Permitting and Compliance, Project and Information Management, Monitoring and Testing, and Others), Media Type (Water Management, Waste Management, and Others), Vertical (Energy and Utilities, Chemical and Petroleum, Manufacturing and Process Industries, Transportation and Construction Industries, and Others), and Geography

Oct 2024

Cloud OSS BSS Market

Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By solution [OSS (Network Management & Orchestration, Resource Management, Analytics & Assurance, and Service Design & Fulfilment) and BSS (Billing & Revenue Management, Product Management, Customer Management, and Others)], Deployment Model (Public Cloud, Private Cloud, and Hybrid Cloud), Enterprise Size (Small & Medium Enterprises and Large Enterprises), and Industry (IT & Telecom, BFSI, Media & Entertainment, Healthcare, and Others), and Geography

Oct 2024

Unified Endpoint Management Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Solutions and Services), Deployment Type (Cloud-Based and On-Premise), Platform (Desktop and Mobile), Organization Size (Large Enterprises and SMEs), End User (BFSI, Government and Defense, Healthcare, IT and Telecom, Automotive and Transportation, Retail, Manufacturing, and Others), and Geography

Oct 2024

AI in Computer Vision Market

Size and Forecast (2021–2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Software and Hardware) and End Use Industry (Security and Surveillance, Manufacturing, Automotive, Retail, Sports and Entertainment, and Others), and Geography