$4550

$3640

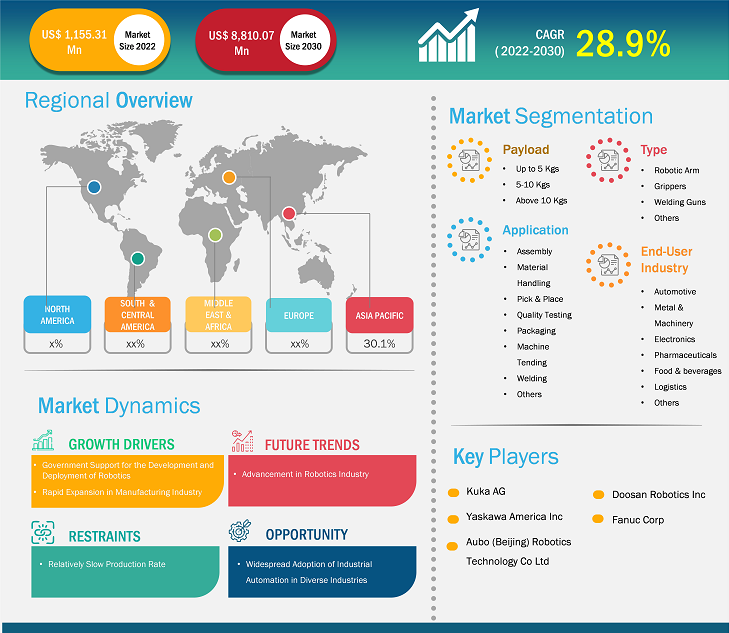

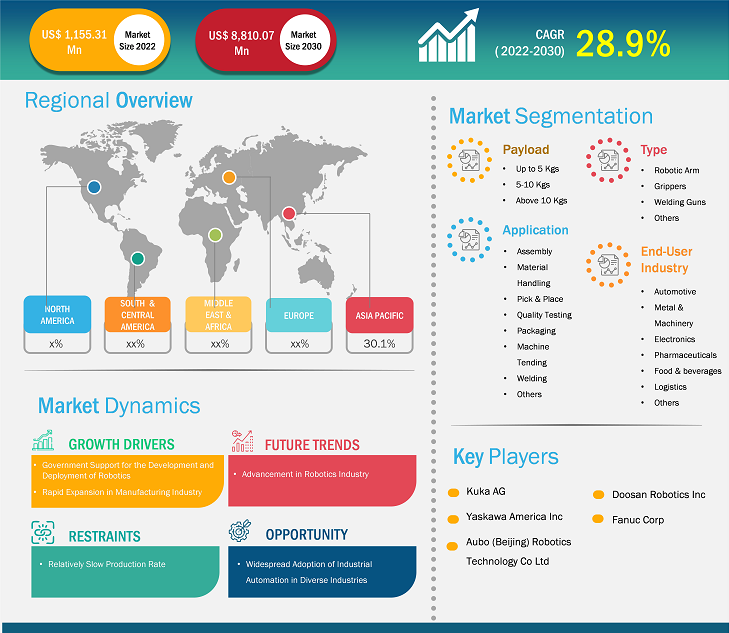

The collaborative robots market size is projected to reach US$ 8.81 billion by 2030 from US$ 1.15 billion in 2022. The market is expected to register a CAGR of 28.9% during 2022–2030. Advancement in robotics industry is likely to remain a key trend in the market.

Collaborative Robots Market Analysis

Growing adoption of collaborative robots in automotive industry and expanding manufacturing, logistics, and e-commerce industries are driving the market. The market is projected to expand at a significant pace during the forecast period, due to the significant government initiatives and support for the development and deployment of robotics. Moreover, the government initiatives to support robotics evolution and the growing focus on industrial automation are creating lucrative opportunities for the market.

Collaborative Robots Market Overview

A collaborative robot, also known as a cobot, is an industrial robot that is used to automate industrial processes. These robots are capable of safely working or operating alongside humans in a shared workspace. In most situations, a collaborative robot does repetitive, menial duties while a human worker handles more complicated and thought-intensive activities. The accuracy, uptime, and reproducibility of collaborative robots are intended to supplement the intelligence and problem-solving abilities of a human worker, further surging its adoption in heavy industries.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Collaborative Robots Market: Strategic Insights

Market Size Value in US$ 1.15 billion in 2022 Market Size Value by US$ 8.81 billion by 2030 Growth rate CAGR of 28.9% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Collaborative Robots Market: Strategic Insights

| Market Size Value in | US$ 1.15 billion in 2022 |

| Market Size Value by | US$ 8.81 billion by 2030 |

| Growth rate | CAGR of 28.9% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Collaborative Robots Market Drivers and Opportunities

Growing Adoption of Collaborative Robots in Automotive Industry to Favor Market

The demand for passenger cars and commercial vehicles is increasing across the globe. Germany is one of the leading producers of automobiles in the world, and many major car manufacturing companies are located in the country, including Volkswagen, BMW AG, Audi, and others. According to the International Organization of Motor Vehicle Manufacturers (OICA) Germany produced over 3.4 million vehicles in 2022, including both passenger cars and commercial vehicles. Approximately 70 percent of most premium brands' vehicles globally are manufactured by German companies. Also, the country's Machinery and Equipment sector is leading in the European region. Moreover, materials processing represents an essential component of the country's industrial culture. The presence of these industries is expected to boost the demand for collaborative robots.

The Government Initiatives to Support Robotics Evolution

Numerous government initiatives supporting the robotics evolution in the country are fueling the growth of the collaborative robot’s market. According to the press release by the International Federation of Robotics 2023, in 2022, the government of Japan granted total funding of US$ 930.5 million under the "New Robot Strategy" program, benefitting the manufacturing sector with US$ 77.8 million, nursing & medical with US$ 55 million, infrastructure with US$ 643.2 million, and agriculture with funding of US$ 66.2 million. The funding aimed to advance air mobility and integrated technology pertaining to artificial intelligence and robots. Furthermore, the government also allocated US$ 440 million from 2020 to 2025 under the "Moonshot Research and Development Program" to develop robotics projects, accelerating the adoption of collaborative robots in Japan.

Collaborative Robots Market Report Segmentation Analysis

Key segments that contributed to the derivation of the collaborative robots market analysis are payload, application, type, and end-user industry.

- Based on payload, the collaborative robots market is divided into up to 5 Kgs, 5-10 Kgs, and above 10 Kgs. The above 10 Kgs segment held a larger market share in 2022.

- In terms of application, the market is divided into assembly, material handling, pick & place, quality testing, packaging, machine tending, welding, and others. The assembly segment held a larger market share in 2022.

- On the basis of type, the collaborative robots market is segmented into the robotic arm, grippers, welding guns, and others. The robotic arm segment held a larger market share in 2022.

- By end-user industry the market is divided into automotive, metal & machinery, electronics, pharmaceuticals, food & beverages, logistics, and others. The automotive segment held a larger market share in 2022.

Collaborative Robots Market Share Analysis by Geography

The geographic scope of the collaborative robots market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The market in Europe is projected to expand during the forecast period, due to the growing adoption of collaborative robots in Germany, France, Italy, the UK, Russia, Sweden, and others to automate industrial processes. The automotive sector of France contributes a major share in its GDP; many companies, including vehicle makers, equipment makers, engine manufacturers, concept designers and car body designers, are located in the country. The patents filed by this sector in the country is more than any other sector in France, which shows the high investment in R&D in the country's automotive sector. Furthermore, the government is constantly introducing new policies to help the country's automobile industry grow. Also, the government is helping the local automobile companies and attracting foreign companies to invest in the country's automobile sector. Furthermore, the country is also well-known for its aerospace industry, ruled by Airbus, one of the leading aircraft manufacturers globally. Additionally, expanding automotive and aerospace industries in Europe is driving the market.

Collaborative Robots Market Report Scope

Collaborative Robots Market News and Recent Developments

The collaborative robots market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the collaborative robots market are listed below:

- Techman Robot collaborated with NVIDIA’s Isaac Sim platform to develop digital twin that enhanced the efficiency of robot production line inspection. This collaboration aims to reduce robot programming time by 70% and cycle time by 20%, resulting in significant time and cost savings. (Source: Techman Robot Inc, Company Website, June 2023).

- Doosan Robotics, a global leader in collaborative robot manufacturing, introduced E-SERIES, an NSF-certified collaborative robot line designed exclusively for the food and beverage (F&B) market. It was established to assist in transforming the food and beverage industry by providing fast solutions to labor shortages and boosting work efficiencies. Its 5kg payload and approximately 3ft reach (900mm) gave enough capability to accomplish any meal duty. (Source: Doosan Robotic Inc, Company Website, April 2023).

Collaborative Robots Market Report Coverage and Deliverables

The “Collaborative Robots Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering below areas:

- Collaborative robots market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Collaborative robots market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Collaborative robots market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the collaborative robots market

- Detailed company profiles

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Payload, Application, Type, and End-User Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The growing adoption of collaborative robots in automotive industry is the major factors that propel the global collaborative robots market.

Europe dominated the collaborative robots market in 2022.

Advancement in robotics industry to play a significant role in the global collaborative robots market in the coming years.

The global collaborative robots market is estimated to register a CAGR of 28.9% during the forecast period 2022–2030.

The global collaborative robots market is expected to reach US$ 8.81 billion by 2030.

The key players holding majority shares in the global collaborative robots market are Kuka AG, Yaskawa America Inc, Aubo (Beijing) Robotics Technology Co Ltd, Doosan Robotic Inc, Fanuc Corp, ABB Ltd, Rethink Robotics GmbH, Universal Robots AS, and Techman Robot Inc.

The List of Companies - Collaborative Robots Market

- Kuka AG

- Yaskawa America Inc

- Aubo (Beijing) Robotics Technology Co Ltd

- Doosan Robotics Inc

- Fanuc Corp

- ABB Ltd

- Rethink Robotics GmbH

- Universal Robots AS

- Techman Robot Inc

- Kawasaki Heavy Industries Ltd

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Collaborative Robots Market

Aug 2023

Collaborative Robots Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Payload (Up to 5 Kgs, 5-10 Kgs, and Above 10 Kgs), Application (Assembly, Material Handling, Pick & Place, Quality Testing, Packaging, Machine Tending, Welding, and Others), Type (Robotic Arm, Grippers, Welding Guns, and Others), End-User Industry (Automotive, Metal & Machinery, Electronics, Pharmaceuticals, Food & beverages, Logistics, and Others), and Geography

Aug 2023

Analog to Digital Converter Market

Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Integrating Analog to Digital Converters, Delta-Sigma Analog to Digital Converters, Successive Approximation Analog to Digital Converters, Ramp Analog to Digital Converters, and Others), Resolution (8-Bit, 10-Bit, 12-Bit, 14-Bit, 16-Bit, and Others), and Application (Industrial, Consumer Electronics, Automotive, Healthcare, Telecommunication, and Others), and Geography

Aug 2023

Adaptive Traffic Control System Market

Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Hardware, Software, and Services), Component (OPAC, SCOOT, RHODES, and SCATS), and Application [Highways and Urban (Cities)] and Geography

Aug 2023

3D Audio Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Component (Hardware, Software, and Services) and End Use Industries (Consumer Electronics, Automotive, Media and Entertainment, Gaming, and Others)

Aug 2023

Data Center Cooling Fans Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Axial Fans, Centrifugal Fans, Mixed Flow Fans, and Others), Data Center Type (Hyperscale Data Center, Colocation Data Center, Wholesale Data Center, Enterprise Data Center, and Edge Data Center), and Geography

Aug 2023

Chillers Market

Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Chiller Technology (Air-Cooled, Water-Cooled, and Steam-Fired), Technology (Process Chillers, Scroll Chillers, Screw Chillers, Centrifugal Chillers, Absorption Chillers, Modular Chillers, and Reverse Cycle Chillers), and Application (Commercial, Industrial, and Residential) and Geography

Aug 2023

Valve Actuator Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By End-user (Mining, LNG, Chemical, Oil and Gas, Water and Wastewater, Others), Product Type (Electrical, Manual, Hydraulic, Pneumatic), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, South & Central America)

Aug 2023

Radiation Hardened Feedback Sensors Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Sensor (Resolver, Encoder, Hall Effect Sensor, Potentiometer, and Others), Application (Space, Aerospace and Defense, Nuclear Power Plant, and Others), and Geography