$4450

$3560

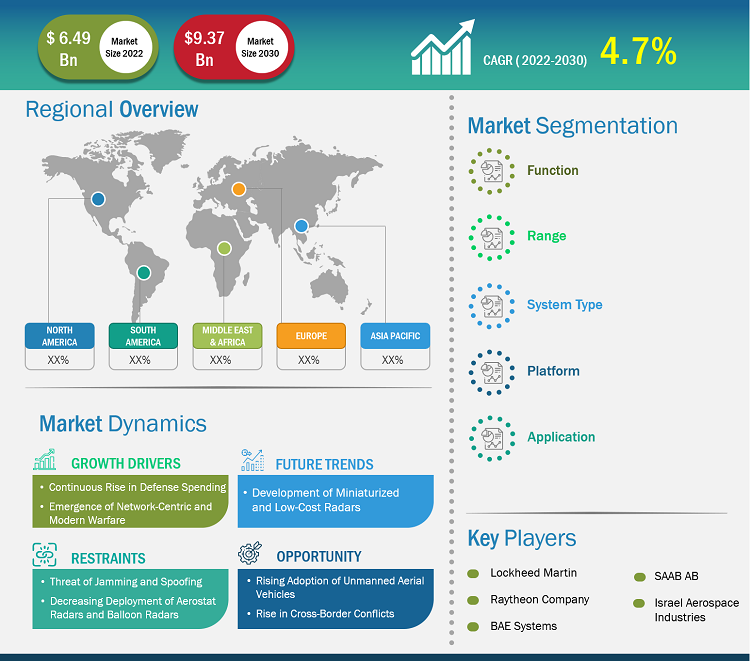

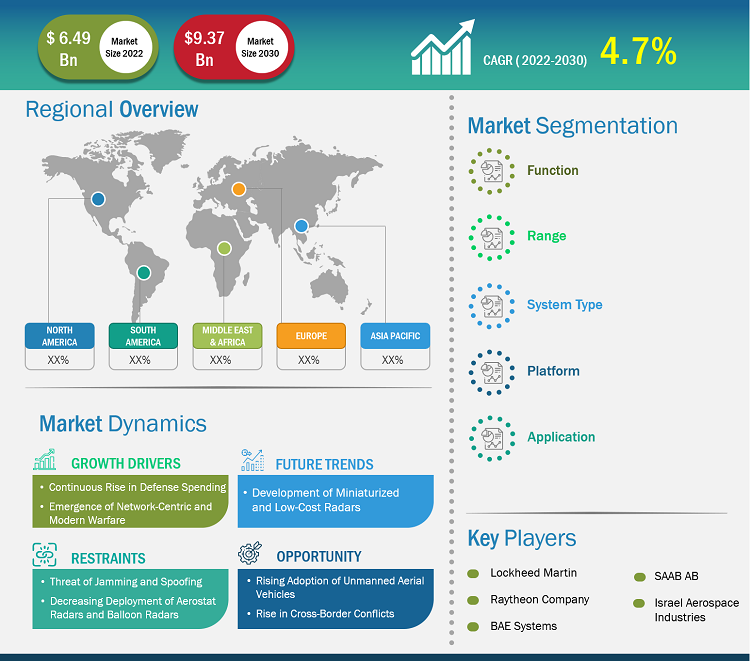

Air Defense Radar Market size is projected to reach US$ 9,368.34 million by 2030 from US$ 6,490.41 million in 2022. The market is expected to register a CAGR of 4.7% in 2022–2030. The development of miniaturized and low-cost radars is likely to remain a key air defense radar market trend.

Air Defense Radar Market Analysis

Jamming and spoofing techniques can degrade the situational awareness provided by air defense radar systems. By interfering with radar signals or providing false information, these techniques can mislead operators and decision-makers, leading to inaccurate assessments of the threat. Reduced situational awareness hampers the ability to effectively respond to airborne threats and can jeopardize overall mission success. Radar system manufacturers and operators continually develop countermeasures to mitigate the impact of jamming and spoofing techniques. These countermeasures may involve advanced signal processing algorithms, adaptive waveform generation, or the integration of complementary sensor systems. However, as countermeasures evolve, adversaries may develop more sophisticated jamming and spoofing techniques, necessitating ongoing investments in research and development. Mitigating the impact of jamming and spoofing techniques often requires the integration of additional technologies and systems into radar architectures. This can increase the cost and complexity of air defense radar systems, making their procurement and maintenance more challenging. Organizations must invest in robust countermeasure capabilities, training, and regular updates to stay ahead of evolving jamming and spoofing techniques.

Air Defense Radar Market Overview

End users of air defense radars can vary depending on the specific application and the organization responsible for defense and security. It can be utilized by military forces such as national armies, air forces, and naval forces and border security agencies. It can also be used in military air traffic control systems. In addition, air defense radars play a crucial role in the air defense systems of NATO (North Atlantic Treaty Organization) and allied forces. These radars also maintain the defense and security of EU member countries, providing situational awareness and contributing to joint defense operations. Also, a few end users of air defense radars can vary on the basis of geopolitical context and the specific requirements of each country or organization.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Air Defense Radar Market: Strategic Insights

Market Size Value in US$ 6,490.41 million in 2022 Market Size Value by US$ 9,368.34 million by 2030 Growth rate CAGR of 4.7% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Air Defense Radar Market: Strategic Insights

| Market Size Value in | US$ 6,490.41 million in 2022 |

| Market Size Value by | US$ 9,368.34 million by 2030 |

| Growth rate | CAGR of 4.7% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Air Defense Radar Market Drivers and Opportunities

Emergence of Network-Centric and Modern Warfare

Network-centric warfare relies on the rapid sharing, fusion, and analysis of data gathered from multiple sources. Air defense radar systems generate essential data for fusion and correlation by using inputs from other sensors and intelligence sources. This facilitates the development of a comprehensive and accurate air picture, enabling more precise threat assessments and target engagements. Thus, network-centric warfare and modern warfare concepts emphasize enhanced situational awareness, integrated defense systems, rapid data sharing, improved target engagement, electronic warfare capabilities, and adaptability to evolving threats. Thus, growing adoption of network centric and modern warfare are further driving developments in advanced radar technologies to support effective air defense in modern operational environments.

Rise in Cross-Border Conflicts – An Opportunity in Air Defense Radar Market

The constant tension across countries such as India–Pakistan, China–Taiwan, China–India, Russia–Ukraine, and Israel-Palestine is compelling their respective governments to strengthen the armed forces. Hence, the armed forces of these countries are focusing on the procurement of air defense systems. Cross-border conflicts often involve threats from airborne platforms, including aircraft, UAS, and missiles. Air defense radar systems play a vital role in border surveillance by detecting and tracking these threats, providing early warning and enabling rapid response capabilities, including evacuation measures. Cross-border conflicts might also lead to the destruction of critical infrastructure, such as airports, power plants, and various government-based facilities. The need for enhanced surveillance to safeguard borders and other critical infrastructure drives the demand for advanced radar systems, including air defense radar systems, in conflict zones. In addition, military forces often establish forward operating bases (FOBs) near conflict zones. These FOBs require robust air defense capabilities to protect personnel and equipment. Air defense radar systems are integral to FOBs, providing surveillance, detection, and response capabilities against airborne threats. Thus, the increase in the utilization of air defense radars in conflict areas is expected to create opportunities for the air defense radar market growth in the coming years.

Air Defense Radar Market Report Segmentation Analysis

Key segments that contributed to the derivation of the air defense radar market analysis are range, product type, system type, platform, and application.

- Based on range, the air defense radar market is divided into long range, medium range, and short range. The long range segment held a larger market share in 2022.

- Based on product type, the air defense radar market is segmented into synthetic aperture and moving target indicator radar, surveillance radar, airborne early warning radar, multi-functional radar, weather radar, and others. The synthetic aperture and moving target indicator radar segment held a larger market share in 2022.

- Based on system type, the air defense radar market is segmented into fixed and portable. The fixed radar segment held a larger market share in 2022.

- Based on platform, the air defense radar market is segmented into ground-based, aircraft-mounted, and naval-based. The ground-based segment held a larger market share in 2022.

- Based on application, the air defense radar market is segmented into ballistic missile defense, identification friend or foe, weather forecasting, and others. The identification friend or foe segment held a larger market share in 2022.

Air Defense Radar Market Share Analysis by Geography

The geographic scope of the air defense radar market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America.

In 2023, North America accounted for a major share in the global air defense radar market followed by Europe and Asia Pacific. The air defense radar market in North America is majorly driven by key players such as General Dynamics Corporation, Honeywell International Inc, Lockheed Martin Corporation, Northrop Grumman Corporation, and Raytheon Technologies Corporation. Further, the geopolitical tension in the region is increasing the military expenditure. According to Stockholm International Peace Research Institute (SIPRI), the military expenditure of North America was US$ 809,723.4 million in 2020; it increased to US$ 840,273.3 million in 2021 and reached US$ 912,375.03 million in 2022. Thus, the growing military budget is stimulating the procurement of various defense systems. According to the World Directory of Modern Military Aircraft (WDMMA) and Global Fire Power Index (FPI), North America currently holds 466 fleets, including frigates, corvettes, destroyers, aircraft carriers, and submarines. Apart from these, in 2023, the region secured 72 fleets for future procurement. As radar systems play an essential role in target identification, tracking capabilities target identification and tracking capabilities of defense systems, the rising procurement of defense systems is expected to propel the demand for air defense radar systems during the forecast period.

Air Defense Radar Market Report Scope

Air Defense Radar Market News and Recent Developments

The air defense radar market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for innovations, business expansion, and strategies:

- In 2023, Honeywell announced that the United States Coast Guard (USCG) has selected Honeywell’s IntuVue RDR-7000 weather radar system as an upgrade to existing systems on its Sikorsky MH-60 Jayhawk and Eurocopter MH-65 Dolphin multimission helicopters. The RDR-7000 upgrade builds on the strong legacy of performance and situational awareness provided by the currently installed Honeywell P701 weather radar system. (Source: Honeywell International Inc, Press Release)

- In 2023, Royal Norwegian Air Force selected the Lockheed Martin TPY-4 next-generation ground-based air surveillance radar to enhance the country’s long-range surveillance capability. Norway’s TPY-4 radars will be integrated into Lockheed Martin’s active production line, making this a low-risk option for the Norwegian Defence Material Agency. (Source: Lockheed Martin Corporation, Newsletter)

Air Defense Radar Market Report Coverage and Deliverables

The “Air Defense Radar Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering the following areas:

- Air Defense Radar Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Air Defense Radar Market trends

- Detailed Porter’s Five Forces

- Air Defense Radar Market analysis covering key market trends, Global and regional framework, major players, regulations, and recent market developments

- Air Defense Radar Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Range, Product Type, System Type, Platform, Application, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Air Defense Radar Market

Aug 2023

Aerospace Stainless Steel And Superalloy Fasteners Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Material Type [Stainless Steel, Superalloy (A286, Inconel 718, Waspaloy, and Others)], Application (Airframe, Engine, Interior, and Others), Aircraft Type (Fixed Wing and Rotary Wing), Product Type (Screws, Rivets, Nut/Bolts, and Others), and Geography

Aug 2023

Military Antenna Market

Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Aperture Antennas, Dipole Antennas, Travelling Wave Antennas, Monopole Antennas, Loop Antennas, Array Antennas, Others); Frequency (High Frequency, Very High Frequency, Ultra-High Frequency); Platform (Marine, Ground, Airborne); Application (Communication, Telemetry, Electronic Warfare, Surveillance, Navigation); and Geography

Aug 2023

Helicopter MRO Market

Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Airframe Maintenance, Engine Maintenance, Component Maintenance, Line Maintenance); Helicopter Type (Light Helicopter, Medium Helicopter, Heavy Helicopter); End User (Commercial, Military); and Geography

Aug 2023

Airport Infrastructure Market

Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Airport Type (Commercial Airport, Military Airport, General Aviation Airport); Infrastructure Type (Terminal, Control Tower, Taxiway & Runway, Hangar, Others); and Geography

Aug 2023

Airport Fueling Equipment Market

Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Tanker Capacity (Below 5000 litres, 5000-20000 litres, Above 20000 litres); Aircraft Type (Civil Aircraft, Military Aircraft); Power Source (Electric, Non-Electric); and Geography

Aug 2023

Aug 2023

Airborne Pods Market

Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Aircraft Type (Combat Aircraft, Helicopters, UAVs and Others); Pod Type (ISR, Targeting, and Countermeasure); Sensor Technology (EO/IR, EW/EA, and IRCM); Range (Short, Long, and Intermediate); and Geography

Aug 2023

Air Defense Radar Market

Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Range (Long Range, Medium Range, Short Range); Product Type (Synthetic Aperture and Moving Target Indicator Radar, Surveillance Radar, Airborne Early Warning Radar, Multi-functional Radar, Weather Radar, Others); System Type (Fixed, Portable); Platform (Ground-based, Aircraft-mounted, Naval-based); Application (Ballistic Missile Defense, Identification Friend or Foe, Weather Forecasting, Others); and Geography