Increasing Focus on Deployment of 5G Network Boosts Wireless Testing Market Growth

According to our latest market study on "Wireless Testing Market Size and Forecast (2021–2031), Global and Regional Share, Trend, and Growth Opportunity Analysis – by Offering, Technology, and Application," the market was valued at US$ 16.28 billion in 2023 and is anticipated to reach US$ 33.40 billion by 2031; it is estimated to record a CAGR of 9.4% from 2023 to 2031. The report includes growth prospects in light of current wireless testing market trends and driving factors influencing the market growth.

The deployment of 5G is accelerating worldwide primarily due to significant investments from governments and private companies. According to the report of the GSM Association, within four years after the arrival of the technology, the number of 5G connections worldwide surpassed 1.5 billion by the end of 2023, making it the fastest-growing mobile broadband technology to date. As of 2023, around 300 commercial 5G networks have been launched globally, covering approximately 40% of the world's population outside of Mainland China. By 2029, this is expected to increase to 80%, highlighting the aggressive pace of rollouts. Also, according to the same report, by the end of 2023, 123 operators in 62 markets worldwide had launched 5G fixed wireless access (FWA) services, i.e., more than 40% of commercial 5G networks included a 5G FWA offering. 5G represents a leap in wireless communication with its ultra-fast speeds, low latency, massive device connectivity, and support for new technologies, such as IoT, autonomous systems, and smart cities. Furthermore, 5G networks are designed to connect billions of IoT devices with higher density and efficiency than previous generations. As IoT devices operate in diverse environments, they are required to be thoroughly tested for different frequencies, data rates, and battery performance. Additionally, 5G networks must be resilient against cyberattacks, especially with the growing number of connected devices and mission-critical applications. Wireless testing ensures that a vast array of IoT sensors, traffic management systems, environmental monitoring devices, and other connected infrastructure communicate seamlessly with low power consumption and minimal interference. Security testing validates encryption, authentication protocols, and the overall security architecture of 5G networks. Thus, the demand for wireless testing is gaining immense traction owing to the increase in 5G deployment, which is likely to have a significant impact on the wireless testing market forecast in the upcoming years.

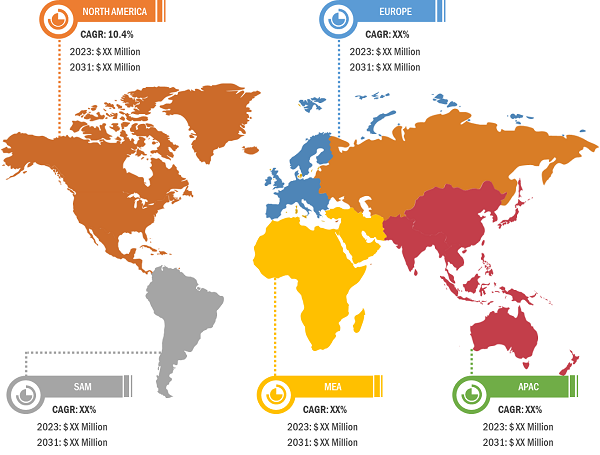

Wireless Testing Market Analysis – by Geography, 2023

Wireless Testing Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Offering [Equipment (Wireless Device Testing and Wireless Network Testing) and Services], Technology (Bluetooth, Wi-Fi, GPS, 2G/3G, 4G/LTE, and 5G), Application (Consumer Electronics, Automotive, IT and Telecommunication, Energy and Power, Medical Devices, Aerospace and Defense, Industrial, and Others), and Geography

Wireless Testing Market Report, Analysis, Opportunities by 2031

Download Free Sample

Source: The Insight Partners Analysis

As IoT devices and networks propel, robust wireless testing becomes essential to ensure their reliability, interoperability, and security. IoT ecosystems involve numerous devices communicating through different wireless protocols, such as Bluetooth, Wi-Fi, Zigbee, LoRaWAN, and 5G. Ensuring these devices work seamlessly with each other requires extensive interoperability testing. As new devices enter the market, manufacturers are mandated to verify that their products communicate effectively within existing IoT environments. Various companies focus on launching testing solutions to certify that the IoT devices work seamlessly and assess networks to identify potential vulnerabilities and loopholes. For instance, in January 2022, CTIA announced the launch of its 5G Security Test Bed (STB) for validating security in commercial 5G networks. 5G is currently the most secure generation of wireless technology with enhanced protections built into it from the ground up. The STB was created with plans to test use cases, make recommendations, and bolster 5G security. Therefore, the rapid integration of IoT with wireless technologies is likely to create substantial opportunities for the wireless testing market.

The scope of the wireless testing market report focuses on North America (the US, Canada, and Mexico), Europe (the UK, Germany, France, Italy, and the Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and the Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America). In Asia Pacific, China held the largest wireless testing market share in 2023. As a result of potential growth in the country's technology sector, the wireless testing market in China is anticipated to see a significant thrust in the upcoming years. China promotes the research and development of 6G wireless technology and is expected to launch an "AI plus" initiative to use AI in promoting new industrialization. The process of establishing a 5G network, computing power, and other information infrastructure is moderate in order to better apply cutting-edge technologies in empowering various industries in China. As cities grow, people will demand efficient networks for innovative city initiatives that advance public services and shift real-time data. In 2024, with the 5G-Advanced campaign, China Mobile commercialized its launch in Beijing. The major players are increasing their presence in China and strengthening their market positions. For example, recently, the global leader in wireless charging technologies, Electron, announced that it took a major step toward transforming the global electric vehicle (EV) charging landscape by entering the market in China. Thus, such developments are expected to offer significant opportunities to the key players, which is likely to have a significant impact on the wireless testing market in the next few years.

In North America, the US held the largest wireless testing market share in 2023. With the US government focusing on implementing wireless technologies, the market is likely to swell considerably. For instance, the US Department of Transportation (USDOT) unveiled Saving Lives with Connectivity: A Plan to Accelerate V2X Deployment as part of its commitment to lowering fatalities and severe injuries on the country's roads. The first plan was made available in draft form for public comment in October 2023. This plan will support USDOT's commitment to pursuing a comprehensive strategy to achieve zero traffic fatalities and direct the rollout of vehicle-to-everything technologies across the country. Also, the plan is focused on ensuring road safety, mobility, and efficiency with technology that allows cars and wireless devices to communicate with each other, as well as roadside infrastructure. Thus, the increasing deployment of wireless technologies is expected to drive the wireless testing market growth in the US. In addition, Canada is one of the most technologically progressed countries in North America. Major players are making significant investments in cutting-edge technology research, which supports the market growth. For example, TELUS is leading the way in wireless innovation in Canada. The company’s wireless connectivity provides platform support and fulfills connectivity needs for international automakers as well as applications. Also, the company has developed an autonomous vehicle test track for a major OEM, funded automotive cybersecurity research at the University of Windsor, established a 5G Living Lab at the University of Alberta, and collaborated with the 5G Automotive Association (5GAA) to test cross-border interoperability.

Anritsu Corporation, Bureau Veritas, Dekra Certification B.V, EXFO, Intertek Group Plc, ThinkPalm, Rohde and Schwarz GmbH and Co, SGS SA, TUV Rheinland, and Viavi Solutions Inc. are among the key players profiled in the wireless testing market report. Several other major players were also studied and analyzed in the market report to get a holistic view of the market and its ecosystem. The market analysis provides detailed market insights, which help the key players strategize their growth.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com