Growing Building and Construction Industry to Bolster Wire and Cable Plastics Market Growth

According to our latest market study on "Wire and Cable Plastics Market Size and Forecast to 2031 – Global Analysis – by Material, Voltage, and End-Use Industry," the market accounted for a revenue of US$ 11.58 billion in 2023 and is projected to reach US$ 17.88 billion by 2031; it is anticipated to record a CAGR of 5.6% from 2023 to 2031. The report includes growth prospects along with the wire and cable plastics market trends and their foreseeable impact during the forecast period.

The building and construction industry's growth is fueled by several factors, including the increasing need for infrastructure development, the rise in residential and commercial construction, and advancements in modern electrical systems. Government bodies of various countries take initiatives to support the development of the residential construction sector. For instance, in Saudi Arabia, the Ministry of Housing and the Real Estate Development Fund initiated the Sakani platform in 2017 to facilitate home ownership by creating new housing stock, allocating plots and homes to nationals, and financing their purchases. In accordance with the aim of reaching 70% home ownership by 2030, the program helped 70,000 families in Q1 of 2021, surpassing its goal of extending help to 51,000 families. According to the Government of Dubai, the city recorded real estate transactions of US$ 143.8 billion (AED 528 billion) in 2022, indicating a 73% increment from 2021. In total, 122,658 real estate units (including residential and commercial) were sold in 2022, reporting an upsurge of 47% compared to 2021. Further, the construction industry has more than 745,000 employers and employs over 7.6 million people to create ~US$ 1.4 trillion worth of structures each year, as per the Associated General Contractors of America (AGC). The US government spending through the National Housing Strategy (NHS) helps encourage energy-efficient construction, leading to an additional demand for residential projects. The government has announced the funding of more than US$ 82 billion for the NHS from 2018–2019 to 2028–2029. Thus, the growing building and construction industry fuels the wire and cable plastics market growth.

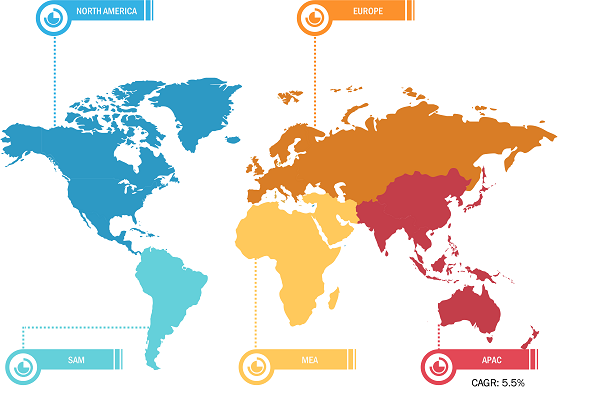

Wire and Cable Plastics Market Breakdown – by Region

Wire and Cable Plastics Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Material (Polyethylene, Polyvinyl Chloride, Polypropylene, Cross-Linked Polyethylene, Thermoplastic Elastomers, and Others), Voltage (Low, Medium, High, and Extra-High), End-Use Industry (Construction, Automotive, Electrical and Electronics, Aerospace and Defense, Telecommunications, Oil and Gas, Energy and Power, and Others), and Geography

Wire and Cable Plastics Market Research Report 2021-2031

Download Free Sample

A few end-use industries, such as construction, automotive, electrical & electronics, aerospace & defense, telecommunications, oil & gas, and energy & power, rely heavily on wires and cables for transmitting power, data, and signals. Each sector has its own set of requirements for wire and cable products, which impacts the type of plastics used in the manufacturing process. For instance, in the automotive industry, cables must be lightweight, flexible, and able to withstand extreme temperatures, while in the telecommunications sector, cables require enhanced durability and resistance to environmental factors such as UV rays and moisture. These industry-specific demands push manufacturers to develop advanced plastic materials with specialized properties, such as flame resistance, high dielectric strength, and chemical resistance. End-use industries are also instrumental in shaping market trends and impacting the evolution of plastics for wire and cable products. As industries move toward increased automation, electrification, and connectivity, the need for more sophisticated and high-performance cables has grown. For instance, the growing adoption of electric vehicles (EVs) spurred the demand for wires and cables that can handle higher voltages and provide insulation that resists heat, chemical exposure, and mechanical stress.

Asia Pacific dominated the global wire and cable plastics market share in 2023. Asia Pacific is one of the prominent markets for utilizing wire and cable plastics, owing to the growing automotive, electronics, construction, and energy & power industries. The automotive industry is significantly driving the wire and cable plastics market in Asia Pacific. As the region continues to witness an increase in automobile production and sales, there is a rise in demand for vehicle components. According to the OICA, Asia-Oceania's vehicle production increased from 50 million in 2022 to 55.1 million in 2023. In addition, in September 2024, Hyundai Motor Company announced a US$ 28 million investment aimed at establishing an EV and battery assembly facility in Thailand. In addition, the rapid adoption of EVs in the region is driving the demand for high-performance wire and cable plastics. Governments of various countries in Asia Pacific are implementing policies to promote EV adoption, leading to the development of charging infrastructure and the use of specialized cables in EVs. Plastics that offer lightweight properties, high thermal resistance, and excellent electrical insulation are crucial for supporting this transition. The telecommunications sector is witnessing significant growth with the rollout of 5G networks and increasing internet penetration in the region, which requires advanced cable solutions with robust plastic insulation to ensure high-speed data transmission, reliability, and protection against electromagnetic interference.

Global Wire and Cable Plastics Market: Trends

The increasing focus on recycling and bio-based materials is expected to emerge as a pivotal trend in the wire and cable plastics market in the coming years, reflecting a shift toward sustainability and environmental responsibility. With growing awareness of the ecological impact of traditional plastic waste and stringent regulations aimed at reducing carbon footprints, manufacturers are exploring innovative ways to produce environmentally friendly wire and cable plastics. This trend is driven by the need to meet regulatory compliance, address consumer preferences for sustainable products, and align with global efforts to transition to a circular economy. In January 2023, Borealis announced the capability to use its proprietary Borcycle C chemical recycling process to recycle cross-linked polyethylene (PE) types such as XLPE and PE-X into recycled polyethylene. The recycled PE obtained in the pyrolysis process can replace virgin PE in manufacturing XLPE and PE-X for use in the wire & cable and infrastructure industries, respectively. In addition, in September 2024, Dow announced the launch of a range of REVOLOOP Recycled Plastics Resins that incorporate post-consumer recycled (PCR) material into cable jacketing to help address customers' varying needs and circularity goals across the globe. The development of advanced recycling technologies allows manufacturers to recover and repurpose plastic materials from end-of-life cables, reducing the dependency on virgin petrochemical-based plastics. Recycled plastics lower raw material costs and minimize the environmental impact of production, making them an attractive option for manufacturers as well as end users.

The demand for bio-based materials in wire and cable production is gaining momentum. These materials are derived from renewable resources such as plant-based polymers and offer a sustainable alternative to conventional plastics. As this trend evolves, it also drives innovation in material science and processing techniques, fostering the development of curable, cost-effective, and sustainable plastic solutions.

The key players in the wire and cable plastics market report are Dow Inc, Exxon Mobil Corp, LyondellBasell Industries NV, Solvay SA, Borealis AG, BASF SE, Saudi Basic Industries Corp, LG Chem Ltd, Arkema SA, and Celanese Corp. The wire and cable plastics market forecast can help stakeholders plan their growth strategies and learn about innovative products that are made available at affordable prices to attract consumers.

The wire and cable plastics market analysis is based on material, voltage, and end-use industry. By material, the wire and cable plastics market is segmented into polyethylene, polyvinyl chloride, polypropylene, cross-linked polyethylene, thermoplastic elastomers, and others. The cross-linked polyethylene segment held the largest wire and cable plastics market share in 2023. In terms of voltage, the market is segmented into low, medium, high, and extra-high. The low segment dominated the wire and cable plastics market in 2023. Based on end-use industry, the market is segmented into construction, automotive, electrical and electronics, aerospace and defense, telecommunications, oil and gas, energy and power, and others. The construction segment dominated the wire and cable plastics market in 2023. The scope of the wire and cable plastics market report focuses on North America (US, Canada, and Mexico), Europe (Germany, France, UK, Italy, Russia, and Rest of Europe), Asia Pacific (Australia, China, India, Japan, South Korea, and Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com