Growing Demand for Gluten-Free Bakery Products

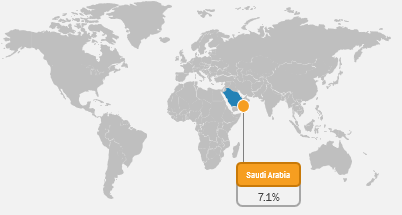

According to the latest market study on “Saudi Arabia Gluten-Free Products Market Forecast to 2031 – Trend and Growth Opportunity Analysis – by Type and Distribution Channel,” the market was valued at US$ 89.71 million in 2023 and is projected to reach US$ 155.30 million by 2031; it is anticipated to record a CAGR of 7.1% from 2023 to 2031. The report highlights key factors contributing to the growing Saudi Arabia gluten-free products market size and prominent players along with their developments in the market.

Many consumers perceive gluten-free products as a healthier option, often associating them with benefits such as improved digestion, weight management, and increased energy levels. The shift toward gluten-free products is driven by rising interest in gluten-free diets among health-conscious individuals. Gluten-free bakery products often emphasize their use of alternative flours made from almonds, coconut, oats, and sorghum, which are perceived as healthier options over conventional wheat. Key market players focus on product developments and launches to expand product offerings with improved sensory characteristics. Advancements in food technology have led to significant improvements in gluten-free products, making them indistinguishable in their texture and taste from conventional food products.

Saudi Arabia Gluten-Free Products Market Breakdown – by Country

Saudi Arabia Gluten-Free Products Market Size and Forecast (2021 - 2031), Country Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type [Bakery Products (Cakes and Muffins, Biscuits and Cookies, Pizza, Bread and Rolls, and Others), Confectionery Bars, Pasta and Noodles, Breakfast Cereals, Snacks, RTE and RTC Meals, Flour, and Others] and Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Retail, and Others)

Saudi Arabia Gluten-Free Products Market Size, Share by 2031

Download Free Sample

The Saudi Arabia gluten-free products market growth has encouraged manufacturers to launch distinct bakery products in Saudi Arabia. In 2023, Mary’s Gone launched three better-for-you ranges that include gluten-free crackers in supermarkets across the Middle East. In 2023, Mondelez International Inc. launched OREO gluten-free mint crème chocolate sandwich cookies. In December 2023, Modern Mills Company launched gluten-free ingredients for bakery products, which include multipurpose flour, pizza and pastry flour, and cake and dessert flour products. In 2022, Siwar Foods launched gluten-free margherita pizza and plant-based pizza in Saudi Arabia.

The escalating emphasis on clean label and fortified gluten-free products is one of the significant Saudi Arabia gluten-free products market trends. As more people adopt healthy lifestyles, they seek products that offer more health benefits than just gluten-free. Consumers have associated clean-label products with better health prospects. While gluten-free products are essential for individuals with celiac disease and gluten intolerance, there is a growing assumption that gluten-free products lack fiber, vitamins, and minerals. To address this gap and appeal to health-conscious consumers, key market players have developed fortified formulations. The demand for functional food products that offer health benefits has also positively influenced the gluten-free products market. Consumer preferences have shifted toward specific health goals, such as improved digestion, enhanced energy level, and better immune function. Gluten-free products fortified with probiotics, omega-3 fatty acids, or antioxidants cater to these needs, offering consumers options to fit their wellness routine.

The influence of international health trends and the availability of global brands in Saudi Arabia have further accelerated the adoption of clean-label products. The major retailers such as Carrefour, Lulu Hypermarket, and online platforms offer international gluten-free brands, thus providing customers with various options that meet international clean-label standards. The trend of clean-label food is a response to a combination of factors such as rising health awareness, demographic shifts, and the influence of international brands. This trend has led to the development of gluten-free, clean-labeled, and fortified products, positioning them as premium and healthy food products. Thus, the growing demand for fortified gluten-free products bolsters the Saudi Arabia gluten-free products market growth.

The Saudi Arabia gluten-free products market analysis is carried out by identifying and evaluating key players in the market. American Garden, Nestle SA, General Mills Inc, Dr. Schar AG, Hunter Foods LLC, Blue Diamond Growers, Mondelez International Inc, Mister Free’d, YummyEarth Inc, and Galletas Gullon SA are among the key players profiled in the Saudi Arabia gluten-free products market report.

The segmentation of the Saudi Arabia gluten-free products market report is as follows:

The Saudi Arabia gluten-free products market is segmented on the basis of type and distribution channel. Based on type, the market is segmented into bakery products (cakes and muffins, biscuits and cookies, pizza, bread and rolls, and others), confectionery bars, pasta and noodles, breakfast cereals, snacks, RTE and RTC meals, flour, and others. The bakery products segment held the largest Saudi Arabia gluten-free products market share in 2023. The gluten-free bakery products tend to have a different texture than traditional breads and treats. Depending on the ingredients, these products are denser and have a gritty texture. Various gluten-free flours, starches, and baking aids are utilized to produce high-quality bakery products, such as cakes and muffins, biscuits and cookies, pizza, bread, and rolls. The gluten-free baked products are known to be a healthier option than traditional wheat flour-based baked products. The rising demand for health-conscious food products has resulted in increased consumption of gluten-free bakery products. By distribution channel, the market is segmented into supermarkets and hypermarkets, convenience stores, online retail, and others. The supermarkets and hypermarkets segment held the largest Saudi Arabia gluten-free products market share in 2023. Supermarkets and hypermarkets are large retail establishments that offer a wide range of products, such as bakery products, RTE and RTC meals, pizza dough, and confectionery bars. Products from different brands are available at reasonable prices in these stores, allowing consumers to shop and find the right product quickly. Supermarkets and hypermarkets focus on maximizing product sales to increase their profit. Manufacturers of tortillas usually prefer to sell their products through supermarkets and hypermarkets owing to their large customer base. In addition, these stores offer attractive discounts, multiple payment options, and a pleasant customer experience. They have modern storage facilities to ensure ideal storage conditions for perishable items. Thus, gluten-free product manufacturers prefer selling their products through supermarkets and hypermarkets.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com