Consumer Focus on Preventive Health Bolsters Nutraceuticals Market Growth

According to our latest study on “Nutraceuticals Market Size and Forecast (2021–2031), Global and Regional Growth Opportunity Analysis – by Type and Distribution Channel,” the market size is expected to grow from US$ 500.77 billion in 2023 to US$ 895.76 billion by 2031; it is estimated to register a CAGR of 7.5% from 2023 to 2031. The nutraceuticals market report emphasizes the key factors driving the market and prominent players along with their developments in the market.

Awareness regarding health and nutrition has increased significantly in the past few years. With busy lifestyles and hectic work schedules, people fail to concentrate on their health, fitness, and nutrition. This has led to an increase in the prevalence of diseases such as obesity, diabetes, high blood pressure, skin problems, and digestive issues. The World Health Organization (WHO) refers to cardiovascular diseases as a leading cause of death across the world. According to a report from the World Heart Federation (WHF), the number of death cases from cardiovascular diseases rose from 12.1 million in 1990 to 20.5 million in 2021. Such a high prevalence of cardiovascular diseases drives consumer focus toward preventive health. As a result, the demand for nutraceuticals such as dietary supplements, and functional food and beverages with nutritional benefits has increased among the masses as they focus on preventive health. Nutraceuticals support the healthy functioning of the digestive tract, along with controlling the growth of harmful microorganisms inside these organs.

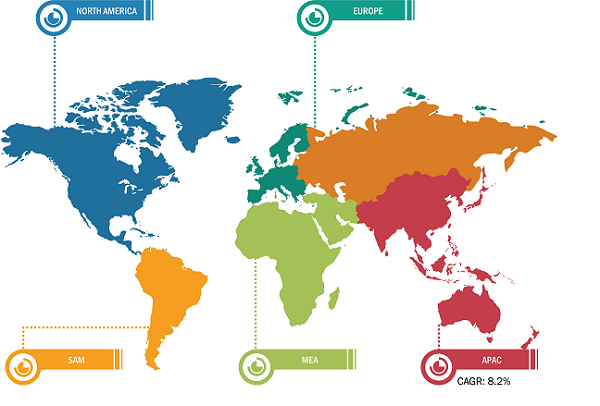

Nutraceuticals Market Breakdown – by Region

Nutraceuticals Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type [Functional Foods, Functional Beverages, and Dietary Supplements [General Wellness, Sports Nutrition, Weight Management, Immune Health, and Others)], Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online Retail, Convenience Stores, and Others), and Geography

Nutraceuticals Market Strategies by 2031

Download Free Sample

Consumers prefer self-directed care while receiving treatment for lifestyle illnesses such as malnutrition and cardiovascular disorders, further contributing to the surging demand for dietary supplements and nutraceuticals. After the COVID-19 pandemic, there has been a sharp rise in the popularity of functional foods and dietary supplements, as people have been prioritizing their health and actively searching for healthy alternatives and fitness activities to prevent lifestyle-related illnesses. Immunity-boosting supplements have gained significant popularity in the last few years due to altered consumer behavior and purchasing habits. Thus, the rising consumer focus on preventive health bolsters the nutraceuticals market growth.

The increasing number of health-conscious consumers worldwide boosts the demand for nutraceuticals with vegan, organic, and plant-based tags. The burgeoning awareness of the more significant nutritional profiles of plant-based nutraceuticals than their traditional counterparts is expected to propel the demand for plant-based nutraceuticals over the forecast period. These products contain collagen, minerals, antioxidants, and carbohydrates in higher amounts with lower fat content, which appeals to consumers seeking healthier nutraceuticals. To keep up with the growing trend of organic and plant-based products, several companies focus on launching plant-based nutraceuticals, along with expanding their existing product lines. In December 2023, Aminolabs announced the launch of Vital Pro XP, a plant-based protein powder, to cater to its vegan consumer base of athletes and fitness enthusiasts. Additionally, in August 2023, PB2 Foods, Inc expanded its protein bar product line by launching PB2 Performance protein bars. These plant-based products, made with non-GMO ingredients and kosher, have been made available in two different flavors: chocolate almond and chocolate peanut butter. Thus, plant-based and organic nutraceuticals are emerging as significant nutraceuticals market trends.

The nutraceuticals market analysis has been performed by considering the following segments: type and distribution channel. Based on type, the market is segmented into functional foods, functional beverages, and dietary supplements. The functional foods segment is anticipated to hold a significant nutraceuticals market share by 2031. Functional food products are formulated in such a way that they contain substances or ingredients that add a health-enhancing or disease-preventing value to them; these functional ingredients are incorporated at concentrations that are sufficiently high to achieve the intended benefits but are safe for consumption. Foods enriched and fortified with nutritional ingredients are part of the functional food. These food products are fortified with specific components or nutritional additives such as omega-3 fatty acids, vitamins, fibers, and minerals to promote optimal health by reinforcing the body's immune systems and reducing the risk of certain diseases. For example, breakfast cereals are usually fortified with nutrients such as vitamins, iron, calcium, and probiotics. Functional food products go beyond standard daily nutrient intake to provide targeted health benefits. They can aid in cholesterol management, improved bone health, and improved heart health, among other benefits. Major brands are increasingly focused on introducing low-sugar and no-sugar functional food, which helps them to stay competitive in the market.

In terms of revenue, North America dominated the nutraceuticals market share in 2023. The US is a major market for nutraceuticals in this region. There is an increased health awareness among consumers in the US due to the high prevalence of chronic diseases and diabetes. According to the US Department of Commerce, as of November 2023, over 37 million Americans were diagnosed with gestational Type 1 or Type 2 diabetes. Such health concerns drive consumers to adopt a healthy lifestyle. The inclination of consumers toward a healthy and fit lifestyle drives the demand for nutraceutical products in the country. Several key market players in the country are focusing on expanding their footprints by unveiling new products in the nutraceuticals market to meet the growing demand. In September 2023, Nutrartis launched Cardiosmile in the US market. This natural supplement containing plant sterols was made available in the liquid form filled in sachets, offering a convenient and effective approach to healthy cholesterol management and heart health. The product is suitable for daily routines.

The nutraceuticals market forecast can help stakeholders plan their growth strategies. Glanbia Plc, NOW Health Group Inc, Amway Corp, Nature's Bounty, Garden of Life LLC, Danone SA, GNC Holdings, LLC, Quest Nutrition LLC, Kellanova, and Chobani LLC are among the prominent players profiled in the nutraceuticals market report. These market players are focusing on providing high-quality products to fulfill customer demand. They are also adopting strategies such as new product launches, capacity expansions, partnerships, and collaborations to stay competitive in the market. For Instance, in December 2022, Amway, a health and wellness company, launched the Singapore Business Innovation Hub in partnership with the Singapore Economic Development Board.

The nutraceuticals market is segmented on the basis of product type, distribution channel, and geography. Based on type, the market is segmented into functional foods, functional beverages, and dietary supplements. The market for dietary supplements is further categorized into general wellness, sports nutrition, weight management, immune health, and others. Based on distribution channel, the market is segmented into supermarkets and hypermarkets, specialty stores, online retail, convenience stores, and others. By geography, the nutraceuticals market is broadly segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. The market in North America is further segmented into the US, Canada, and Mexico. The market in Europe is subsegmented into Germany, France, Italy, Spain, the UK, and the Rest of Europe. The market in Asia Pacific is further segmented into China, India, Japan, Australia, South Korea, and the Rest of Asia Pacific. The nutraceuticals market in the Middle East & Africa is further segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. The market in South & Central America is segmented into Brazil, Argentina, and the Rest of South & Central America.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com