High Myopia Segment to Dominate Myopia Treatment Market Based on Type During 2022–2030

According to our new research study on "Myopia Treatment Market Size and Forecast (2020–2030), Global and Regional Share, Trend, and Growth Opportunity Analysis," the market value is projected to grow from US$ 10,276.67 million in 2022 to US$ 19,571.85 million by 2030. The myopia treatment market is further anticipated to record a CAGR of 8.39% from 2022 to 2030. Key factors driving the market growth are rising prevalence of myopia and increased awareness of myopia treatment. However, the lack of skilled professionals hinders the myopia treatment market growth.

The rising availability of advanced technologies for treating targeted myopia creates lucrative opportunities for the myopia treatment market. Advances in technologies such as laser-assisted in-situ keratomileusis (LASIK), photorefractive keratectomy (PRK), and implantable collamer lenses (ICL) have made it possible to correct myopia more effectively and with fewer complications. In August 2023, Johnson & Johnson Vision launched a next-generation laser vision correction solution, the ELITATM Platform, during the 41st European Society of Cataract and Refractive Surgeons (ESCRS) congress. Various ground-breaking data was also presented during the congress; over 30 abstracts backed by Johnson & Johnson Vision have been approved for presentation. Surgeons can apply the innovative SILK (i.e., Smooth Incision Lenticule Keratomileusis) treatment to treat myopic patients who have astigmatism or do not utilize the ELITATM Platform. The ELITATM Platform offers surgeons an exceptionally smooth and uncomplicated lenticular removal procedure with next-day outcomes and recovery owing to its fast laser delivery technology and ultra-precise laser pulse. These advanced technologies have traditionally been expensive and inaccessible to many patients. As they become more widely available, they present an opportunity for the myopia treatment market to expand its reach and provide better treatment options to a larger patient population. In addition to these advanced technologies, other emerging treatments such as orthokeratology (ortho-k) and atropine eye drops are gaining popularity as effective methods for managing myopia. In May 2021, CooperVision Specialty EyeCare's Procornea DreamLite night lenses received European approval for slowing myopia progression in children and young adults. The popular orthokeratology contact lens is the latest CooperVision myopia control product to gain the CE Mark, joining EyeDream and Paragon CRT ortho-k designs, MiSight day soft contact lenses, and SightGlass Vision Diffusion Optics Technology spectacle lenses. These non-invasive treatments can be more affordable than surgical options, making them accessible to a wider range of patients. Overall, the rising availability of advanced technologies for treating targeted myopia presents a significant opportunity for the myopia treatment market. By providing patients with more effective and accessible treatment options, the market can help improve vision health outcomes and address a significant unmet need in the global healthcare landscape.

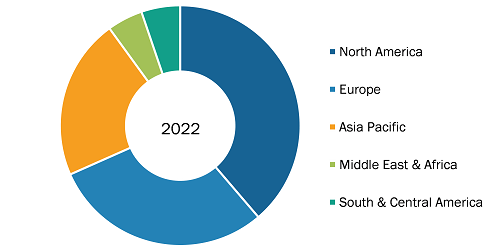

Myopia TreatmentMarket, by Region, 2022 (%)

Published Report - Myopia Treatment Market Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (High Myopia, Degenerative Myopia, Progressive Myopia), Treatment [Low-Dose Atropine Eye Drops, Contact Lenses, Ortho-K, and Refractive Surgery (LASIK, PRK)], Age Group (Adult Myopia and Childhood Myopia), End User (Hospitals and Clinics, Specialty Clinics, and Refractive Surgery Centers), and Geography

Myopia Treatment Market Share and Size Analysis| 2030

Download Free Sample

Source: The Insight Partners Analysis

Haag-Streit Holding (Metall Zug), 2EyesVision, Ziemer Group, NIDEK CO., LTD, Alcon, Carl Zeiss AG, CooperVision, Bausch Health, Johnson & Johnson Vision (Johnson & Johnson), and Topcon Healthcare Inc are among the key companies operating in the myopia treatment market. The companies have been implementing organic strategies (such as product launches and product approvals) and inorganic strategies (such as expansions, collaborations, and partnerships) to secure growth in the market. For instance, in December 2022, NIDEK CO., LTD launched the innovative Fully Assisted Refraction System (FARS). FARS is an optional kit for the TS-610 NIDEK Tabletop Refraction System for performing subjective refractions that integrates the chart and refractor into a single unit. FARS is used to determine the full refractive correction based on patient response using objective data or spectacle prescription as the starting point. The kit consists of a joystick controller and the FARS application software.

The report segments the myopia treatment market as follows:

The myopia treatment market, based on type, is segmented into high myopia, degenerative myopia and progressive myopia. The high myopia segment held the largest share in the myopia treatment market in 2022. High myopia, also known as pathological or degenerative myopia, represents an advanced form of nearsightedness characterized by a significantly elongated eyeball and an increased risk of ocular complications. Individuals with high myopia often experience severe visual impairment and are susceptible to a range of sight-threatening conditions, including retinal detachment, myopic maculopathy, glaucoma, and choroidal neovascularization.

The myopia treatment market, based on treatment, is segmented into low dose atropine eye drops, refractive surgery, contact lenses, and ortho-k. The low-dose atropine eye drops segment held the largest share in the myopia treatment market in 2022. Low-dose atropine eye drops are a promising treatment for myopia, particularly in children and adolescents. Myopia, often known as nearsightedness, is a frequent refractive defect that results in fuzzy images of distant objects. Atropine is a medicine that can help slow down the progression of myopia by lowering the focusing muscles in the eye and dilating the pupil.

By age group, myopia treatment market segmented into adult myopia and childhood myopia. The adult myopia segment held a larger share in the myopia treatment market in 2022. Adult myopia, characterized by difficulty seeing objects at a distance, often requires corrective lenses for clear vision. The onset and progression of myopia in adulthood can impact various characteristics of daily life, from reading and computer work to driving and participating in outdoor activities. Beyond the inconvenience of relying on corrective measures, adult myopia can lead to long-term ocular health concerns, including an increased risk of developing myopic maculopathy, cataracts, and glaucoma.

In terms of end user, the myopia treatment market is classified into hospitals and clinics, specialty clinics, and refractive surgery centers. The hospitals and clinics segment held the largest share in the myopia treatment market in 2022. Hospitals and clinics are the primary healthcare facilities that offer treatments for various diseases and health conditions. The hospitals provide primary care with the best facilities and patient services.

Geographically, the myopia treatment market is segmented into North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com