Assay Development Segment to Bolster Microbiology CRO Services Market Growth During 2023–2031

According to our new research study on "Microbiology CRO Services Market Forecast to 2031 – Global Analysis – by Service Type, Application, Microorganisms, and End User," the market was valued at US$ 5.52 billion in 2023 and is expected to reach US$ 11.51 billion by 2031; it is expected to register a CAGR of 9.6% from 2023 to 2031. The microbiology CRO services market report emphasizes the trends prevalent in the global market, along with drivers and deterrents affecting its growth.

The increasing number of clinical trials, the practice of outsourcing trials to CROs, and increasing research and development investments are among the factors contributing to the growing microbiology CRO services market size. However, the shortage of skilled professionals hampers the market growth. Further, the rise in partnerships and collaborations with service providers is expected to bring new microbiology CRO services market trends in the coming years.

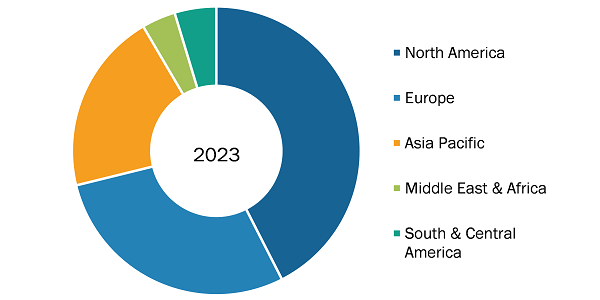

Microbiology CRO Services Market Share, by Region, 2023 (%)

Microbiology CRO Services Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Application (Clinical, Medical Device, and Others), Service Type (Assay Development, Custom Viral Stock Production, Microbial Testing, and Others), Microorganisms (Bacteria, Fungi, Viruses, and Parasites), End User (Biotech and Pharmaceutical Companies, Medical Device Companies, and Others), and Geography

Microbiology CRO Services Market Size and CAGR by 2031

Download Free Sample

Source: The Insight Partners Analysis

Surging Research and Development Investments Propel Microbiology CRO Services Market Growth

Research and development expenditure is instrumental in companies' efforts to discover, examine, and produce new products; make upfront payments; improve existing outcomes; and demonstrate product efficacy and regulatory compliance before launch. These investments differ as per the need and demand for clinical trials. The cost includes materials, supplies used, and employee salaries, along with the cost of developing quality control. According to the PhRMA Member Companies 2021 report, in terms of revenue, the top 15 largest pharmaceutical companies invested US$ 133 billion in research and development cumulatively, and ~44% of the total research and development investment was allocated to clinical trials. Pharmaceutical companies are investing heavily in research and development to create new antibiotics, vaccines, and treatments for infectious diseases. These developments require thorough testing and validation of microbial strains. Similarly, medical device companies are working on innovative products, such as implantable devices, wound care products, and surgical instruments, which also require rigorous testing to ensure sterility and prevent contamination. Microbial testing CROs offer specialized services, including bacterial identification, antimicrobial susceptibility testing, sterility testing, bioburden testing, and molecular testing, to support these research and development efforts. The increasing demand for personalized medicine, targeted therapies, and implantable devices is also boosting the need for microbial testing CROs to provide customized testing services. Thus, increasing research and development investments drive the microbiology CRO services market.

The microbiology CRO services market analysis has been carried out by considering the following segments: service type, application, microorganisms, end user and geography. Based on application, the market is segmented into clinical, medical device, and others. The clinical segment held the largest share of the market in 2023; it is also expected to record the highest CAGR from 2023 to 2031. Clinical microbiology focuses on detecting, characterizing, and quantifying pathogens from patient samples such as blood and urine to enable the diagnosis, treatment, and management of respiratory, STI, hospital-acquired infections, gastrointestinal diseases, gynecological disorders, and cancer. Innovotech, TheraIndx Lifesciences Pvt. Ltd, Charles River Laboratories, and many other contract research organizations (CROs) offer microbiology testing services for various clinical microbiology applications, including infectious disease research, drug development, vaccine development, and biotechnology research. Charles River Laboratories, a leading provider of microbiology testing, has in-house expertise and offers disease models and in vitro screening for bacterial, viral, and fungal pathogens.

Statens Serum Institut (SSI), one of the leading CROs operating in the market, provides services such as antimicrobial evaluation, assay design and development, detection of viruses, development of monoclonal and polyclonal antibodies, and experimental infection models for clinical microbiology studies done to evaluate in vitro evaluation of antimicrobials and in vivo drug efficacy.

Based on service type, the microbiology CRO services market is segmented into assay development, custom viral stock production, microbial testing, and others. The microbial testing segment held the largest share of the market in 2023. Antimicrobial effectiveness, bioburden testing, disinfectant efficacy testing, sterility testing, parasite testing, growth promotion testing, antimicrobial susceptibility testing, microbial identification, and toxicological testing are a few of the crucial microbial testing methods required for clinical and preclinical drug development studies. These methods are recommended by regulatory bodies such as the Food and Drug Association (FDA) and the European Medicines Agency (EMA) for the detection and quantification of microbial contamination, medical device sterilization, and preclinical studies. Bioburden testing, or total viable count testing, measures microbial contamination levels in a product. Such contamination can come from raw materials, the workforce, or the manufacturing environment. Due to multiple sources of contamination, regular testing is advisable. STERIS is one of the leading bioburden testing services for medical devices, pharmaceuticals, animal tissue, and cosmetics. Pharmaceutical companies can improve drug development by outsourcing toxicological testing to CROs.

In terms of microorganisms, the microbiology CRO services market is segmented into bacteria, fungi, viruses, and parasites. The bacteria segment held the largest share of the market in 2023. Bacterial testing is crucial for preclinical and clinical studies of pharmaceutical drugs, vaccines, and sterility testing of medical devices. Microbiological limit tests are utilized to detect the presence of specific live bacteria in pharmaceutical products or drug and biological samples, both qualitatively and quantitatively. Microbial limits test, LAL and bacterial endotoxins testing, bioburden testing, and other microbiological tests are a few of the essential assays conducted for screening bacterial growth in various drug samples. Since 2012, the United States Pharmacopeia (USP) has started demanding bacterial endotoxin criteria based on the maximum human dosage for monograph constituents that might be used in sterile products. In addition, isolation, banking, and characterization of bacterial strains is the initial and most crucial step in the development of live biotherapeutic product (LBP).

Based on end user, the microbiology CRO services market is segmented into biotech and pharmaceutical companies, medical device companies, and others. The biotech and pharmaceutical companies segment held the largest share of the market in 2023.

The geographic scope of the microbiology CRO services market report includes the assessment of the market performance in North America (US, Canada, and Mexico), Europe (Spain, UK, Germany, France, Italy, and Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and Rest of Asia Pacific), South & Central America (Brazil, Argentina, and Rest of South & Central America), and the Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa). In terms of revenue, North America held the largest microbiology CRO services market share in 2023. Further, Asia Pacific is anticipated to record the highest CAGR in the market during the forecast period. Countries such as Australia, India, and South Korea are estimated to witness various growth opportunities owing to the development in the healthcare sector. In addition, governments of these countries are increasing their efforts to provide clinical trials. Also, the rise in the incidence of chronic diseases is likely to offer more significant growth opportunities to the market players in the coming years.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com