Surge in Government Support for Infrastructure Development Propels Industrial Explosives Market Growth

According to the latest market study on “Industrial Explosives Market Forecast to 2031 – Global and Regional Share, Trend, and Growth Opportunity Analysis – by Type and Application,” the market was valued at US$ 23.51 billion in 2023 and is projected to reach US$ 35.77 billion by 2031; it is anticipated to record a CAGR of 5.4% from 2023 to 2031. The report highlights key factors contributing to the growing industrial explosives market size and prominent players along with their developments in the market.

Industrial explosives play a major role in infrastructure development, providing an efficient and cost-effective means for large-scale excavation and demolition. Their applications span from the construction of roads, dams, tunnels, and other civil engineering projects. The utilization of industrial explosives allows for the rapid breaking of rock and other hard materials, which is essential for creating foundations and facilitating the extraction of resources. In mountainous regions, tunnels are constructed to ensure the passage of roads and railways. Blasting allows engineers to efficiently carve through rocks, resulting in the formation of stable tunnels. The development of dams and reservoirs also relies heavily on industrial explosives. Controlled blasting techniques are used for the removal of substantial amounts of rock.

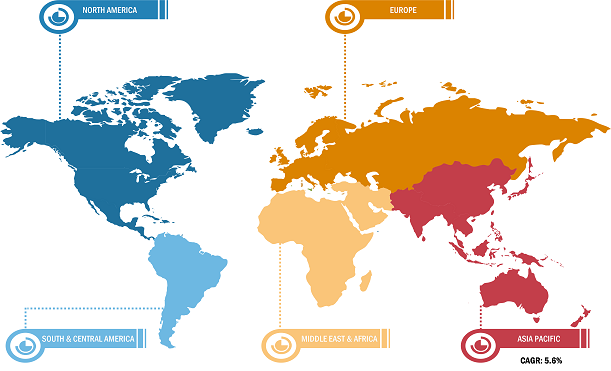

Industrial Explosives Market Breakdown – by Region

Industrial Explosives Market Share and Growth (2021-2031)

Download Free SampleIndustrial Explosives Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (High Explosives, Blasting Agents, and Low Explosives), Application (Mining, Construction, and Others), and Geography

The government-supported infrastructure projects generally include roads, dams, bridges, tunnels, ports, airport pavements, and highways. The growing investments from government organizations lead to a rise in infrastructure construction. In 2022, the Department for Transport of the UK announced the funding of US$ 34.83 million to develop net zero highways. In 2022, the Roads and Transport Authority of the UAE commenced phase 1 of the Sheikh Rashid bin Saeed Corridor Improvement Scheme, building four bridges and a four-lane road. Thus, the rise in government support for infrastructure development is expected to foster the industrial explosives market growth during the forecast period.

The mining industry is the major consumer of explosives, accounting for ~75–80% of the market share. The industry considers blasting an essential component for the success of their operations. Ammonium nitrate is a widely used component for formulating explosives and blasting agents. Utilization of high-energy explosives enhances the fragmentation of rocks, which helps conduct mining operations efficiently. Moreover, the growing construction industry significantly boosts the growth of the industrial explosives market.

A few large manufacturers are vertically integrated, seeking control over all operations from raw material procurement to delivery to end users. This helps in managing costs, ensuring quality, and maintaining a steady supply of products. The industrial explosives market is highly regulated to prevent accidents and misuse. Therefore, companies invest heavily in compliance, including safety training, secure storage, and transportation protocols. The regulatory environment drives innovation in safety technologies, such as electronic detonators and advanced monitoring systems, to enhance safety standards. In addition, the shifting demand towards environment-friendly explosives is expected to set the latest industrial explosives market trends.

The industrial explosives market analysis is carried out by identifying and evaluating key players operating in the market across different regions. Orica Ltd; AECI Ltd; Austin Powder Company; Dyno Nobel Ltd; Enaex SA; MaxamCorp Holding, S.L., Solar Industries India Ltd; EPC Groupe; Keltech Energies Ltd; and Hanwha Corp, are among the key players operating in the industrial explosives market.

Industrial Explosives Market Report Segmentation:

The global industrial explosives market is segmented on the basis of type and application. Based on type, the market is segmented into high explosives, blasting agents, and low explosives. Based on application, the market is categorized into mining, construction, and others.

Based on type, the blasting agents segment accounted for the largest industrial explosives market share in 2023. A blasting agent is a material or mixture consisting of a fuel and oxidizer; in this, none of these ingredients are classified as an explosive, but the entire mixture is utilized for blasting. This agent is primarily made of inorganic nitrates such as ammonium, sodium, and carbonaceous fuels. The blasting agents include slurries and emulsions, ANFO, and blends. Slurries are known as a dense blasting agent (DBS), a mixture of a sensitizer, oxidizer, water, and thickener. The sensitizer is a reducing chemical such as trinitrotoluene (TNT). The oxidizer is ammonium nitrate, and the thickener is guar gum or starch. High-density slurry is more effective as compared to ANFO, due to which it can be utilized for smaller diameter boreholes and wider borehole spacing to obtain explosive power and fragmentation. These factors drive the industrial explosives market.

Based on application, the mining segment held the largest industrial explosives market share in 2023. Thus, the growing need for furniture and increasing consumer preferences have propelled the industrial explosives market. Metal mining is one of the integral parts of the mining sector and contributes significantly to the growth of other manufacturing industries such as automotive, construction, electronics, etc. Metals are classified into two categories—precious metals and industrial metals. Gold, platinum, and silver are a few examples of precious metals. These metals are rare and have a high economic value. Metal mining uses less explosives than coal mining as metallic minerals are generally low-grade ores found only in geologically favorable areas.

Asia Pacific marks the presence of major mining companies such as Mitsubishi Materials Corporation, Jiangxi Copper Co Ltd, Aluminum Corporation of China Ltd, Coal India Limited, China Molybdenum Co Ltd, BHP, etc. In June 2024, Seksiui, an Osaka-based developer, was notified by the municipal government of Japan to cancel the project and demolish the 10-storey, 18-unit building in Kunitachi. In July 2024, Koh Samui municipality (Thailand) suspended a Chinese-owned luxury resort project on Koh Samui due to permit issues, resulting in possible demolition. According to the National Investment Promotion & Facilitation Agency, India allocated an investment budget of US$ 1.4 trillion in infrastructure under the National Infrastructure Pipeline by 2025, of which 18% accounted for roads and highways, 17% accounted for urban infrastructure, and 12% for railways.

India marks the presence of 1,533 operational mines. It produces 95 minerals, which include 4 fuels and 10 metallic, 23 nonmetallic, 3 atomic, and 55 minor minerals. In 2023, the production of copper concentrate, chromite, phosphorite, manganese ore, coal, limestone, and lead concentrate recorded growth of 41.9%, 34%, 32.8%, 13.6%, 12.5%, 7.6%, and 6.3%, respectively, compared to 2022. The growth of the mining industry in India is projected to boost the demand for industrial explosives during the forecast period. In 2022, Japan announced the extraction of rare earth metals from the deep seabed near Minami-Torishima Island by 2024.

The industrial explosives market report scope is broadly segmented into North America (US, Canada, and Mexico), Europe (Germany, France, UK, Italy, Russia, and Rest of Europe), Asia Pacific (China, India, Japan, Australia, South Korea, and Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com