Asia Pacific Dominated Cling Films Market in 2023

According to our latest market study on “Cling Films Market Forecast to 2031 – Global Analysis – by Material Type, Form, and End Use,” the market was valued at US$ 5.48 billion in 2023 and is projected to reach US$ 8.22 billion by 2031; it is anticipated to record a CAGR of 5.2% from 2023 to 2031. The report includes growth prospects owing to the current cling films market trends and their foreseeable impact during the forecast period.

In 2023, Asia Pacific dominated the global cling films market share. The regional market is witnessing lucrative opportunities due to the growing end-use industries, including pharmaceuticals, food & beverages, consumer goods, and others. Cling films, known for their superior sealing and preserving properties, have become essential in household and commercial settings. These films are extensively used to wrap food products, ensuring their prolonged freshness and reducing food waste. The increasing consumer awareness about food safety and hygiene, coupled with the emerging trend of packaged and ready-to-eat foods, propels the demand for cling films across the region. The food & beverage market in Asia Pacific is witnessing growth due to the availability of various innovative varieties of processed and packaged food products and growing demand from the millennial population. The foodservice sector in Asia Pacific is rapidly expanding owing to rapid economic growth, improving lifestyles of consumers, growing tourism sector, and rising disposable income levels. Countries such as Singapore serve as a logistic hub and host the headquarters for several key buyers of food products in the region. This results in an increased production of food products, which propels the demand for cling films as a packaging material in the food industry.

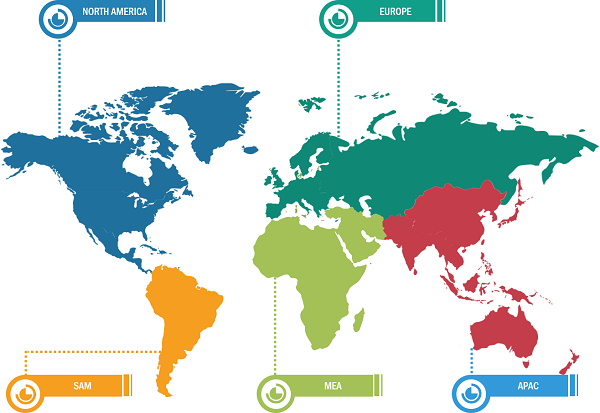

Global Cling Films Market Breakdown – by Region

Cling Films Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Material Type (Low Density Polyethylene, Biaxially Oriented Polypropylene, Polyvinyl Chloride, Polyvinylidene Chloride, and Others), Form (Cast Cling Film and Blow Cling Film), End Use (Food, Healthcare and Pharmaceuticals, Consumer Goods, Industrial, and Others), and Geography

Cling Films Market Size, Growth and Share by 2031

Download Free Sample

The growing food service and pharmaceutical industries in countries such as India, China, Japan, and South Korea propel the demand for different cling films. In recent years, the food processing sector has emerged as a key contributor to India's economy, mainly due to progressive policy initiatives implemented by the Ministry of Food Processing Industries (MoFPI). In urban India, the trend of dining out is increasing. The penetration of online food delivery platforms is also growing in the country. In India, the food truck or mobile kitchen business is in its nascent stage and has huge growth potential as on-the-go food is becoming the preferred lifestyle due to busy schedules. Further, India is one of the largest manufacturers of generic drugs globally, known for its affordable vaccines and generic medications. Also, the country has the largest number of pharmaceutical production facilities that are US Food and Drug Administration (USFDA)-compliant, with 500 active pharmaceutical ingredients (APIs) makers accounting for ∼8% of the global API industry. With increasing pharmaceutical production, the demand for cling films is growing at a significant pace in the country. Most food service providers in Japan use cling films for food packaging due to their ability to extend the shelf life of the food products. Additionally, the food & beverages industry plays a major role in the economic development of South Korea. In the industry, cling films are preferred for packaging, mainly due to various factors such as high resistance to external conditions, cost-effectiveness, effective barrier properties, and high durability. Thus, the rapid development in the food industry in South Korea provides a huge opportunity for the key players operating in the cling films market. In addition, increasing focus on manufacturing and growing end-use industries are enhancing the demand and supply of cling films in South Korea. The growing healthcare industry is another driver of the cling film market growth in the country as cling films provide high levels of protection; cost-effectiveness; insulation from external surroundings; and ease of handling for medical equipment, devices, drugs, vaccines, and others.

In terms of revenue, China accounted for the largest cling films market share in Asia Pacific. China, with a population exceeding 1.4 billion, represents one of the largest and most lucrative markets for cling films globally. The country's rising middle-class population; increasing disposable income; and surging demand for cling films from the food, pharmaceuticals, and consumer goods sectors propel the cling films market growth in China. Growing food production, with rising demand for efficient packaging material, is driving demand for cling films. According to the United States Department of Agriculture (USDA), in the third quarter of 2022, China's food production grew by 12.6% in value terms over prior year levels. This was 2.6% higher than average industrial growth. The rising consumption of RTE foods is also augmenting the market growth in the country. Due to growing food safety awareness in China, an increasing number of consumers have shifted to shopping for food products at supermarkets and on e-commerce platforms instead of traditional food markets. According to the USDA, in 2022, online shopping or e-commerce of agricultural products hit a record US$ 78 billion, up 9.2% year-on-year. Thus, increasing consumers' exposure to prepared foods fuels the cling films market growth in China.

Global Cling Films Market: Trends

Consumers increasingly seek products that offer enhanced performance features such as superior sealing capabilities, extended freshness, and increased durability. Thus, manufacturers are driven to innovate and develop advanced cling film solutions. In December 2023, Berry Global launched a new version of Omni Xtra polyethylene cling film for fresh food applications. The film provides a high-performance alternative to traditional polyvinyl chloride (PVC) cling films. Moreover, the increasing inclination toward convenience and versatility in food packaging contributes to the demand for functional cling films. With busy lifestyles and the rise of meal prepping, consumers are looking for packaging that can withstand various conditions such as refrigeration, freezing, and microwave heating. Functional cling films that meet these demands enhance user experience and expand the scope of their applications. By addressing these evolving consumer needs, functional cling films are expected to gain a broader customer base. Therefore, the rising demand for functional cling films would contribute to the growing cling films market size in the future.

Berry Global Group Inc, Adex S.r.l., Anchor Packaging LLC, Cedo Ltd, The Interpublic Group of Companies Inc, MOLCO GmbH, Multiwrap, Dow Inc, POLIFILM, and Mitsubishi Chemical Group Corp, are among the key players profiled in the cling films market report.

The cling films market involves the segmentation of the market based on:

The cling films market analysis is based on material type, form, end use, and geography. Based on material type, the market is segmented into low density polyethylene, biaxially oriented polypropylene, polyvinyl chloride, polyvinylidene chloride, and others. By form, the market is bifurcated into cast cling film and blow cling film. In terms of end use, the market is segmented into food, healthcare and pharmaceuticals, consumer goods, industrial, and others. The scope of the cling films market report focuses on North America (the US, Canada, and Mexico), Europe (Germany, France, the UK, Italy, Russia, and the Rest of Europe), Asia Pacific (China, India, Japan, Australia, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com