Rising Military Expenditure Boosts Australia and New Zealand Thermal and Acoustic Imaging Market Growth

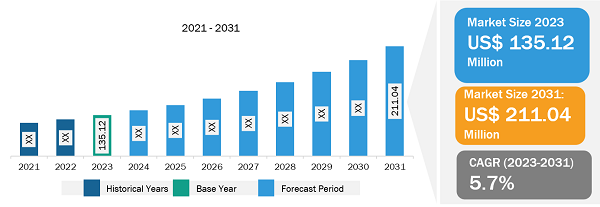

According to our latest market study on "Australia and New Zealand Thermal and Acoustic Imaging Market Size and Forecast (2021–2031), Trend, and Growth Opportunity Analysis — by Thermal Imaging and Acoustic Imaging," the market was valued at US$ 135.12 million in 2023 and is anticipated to reach US$ 211.04 million by 2031; it is estimated to record a CAGR of 5.7% from 2023 to 2031. The report includes growth prospects in light of current Australia and New Zealand thermal and acoustic imaging market trends and driving factors influencing the market growth.

According to the Stockholm International Peace Research Institute (SIPRI), in April 2024, global military spending surged amid wars and rising geopolitical tensions. The change in the modern warfare system has been urging governments across the globe to allocate higher funds toward respective military forces. The budget allocation enables military forces to procure advanced technologies and equipment from domestic or international manufacturers. Along the same lines, military vehicle modernization practices are also rising in Australia and New Zealand. The defense forces across Australia and New Zealand are investing substantial amounts to strengthen military forces with advanced technologies, armaments, artilleries, and vehicles, among others. The continuous demand for new technologies for combat and noncombat operations by the defense forces is further boosting the defense spending in these countries. According to Australia's budget for 2024–2025, the government will spend US$ 36.8 billion on defense, an increase of 6.3% compared to 2023–2024. In the most recent budget release for the fiscal year 2024–2025, the government has set aside US$ 25.2 billion for equipment acquisitions in the coming fiscal year. Under the New Zealand 2023–2024 defense budget, the Royal New Zealand Navy is set to get about US$ 418 million (NZ$ 714 million), an increase from the previous year's US$ 391 million (NZ$ 667 million).

Australia and New Zealand Thermal and Acoustic Imaging Market

Australia and New Zealand Thermal and Acoustic Imaging Market Size and Forecast (2021 - 2031), Country Share, Trend, and Growth Opportunity Analysis Report Coverage: By Thermal Imaging [Type (Thermal Cameras, Thermal Scopes, and Thermal Modules), Technology (Cooled and Uncooled), Wavelength (SWIR, MWIR, and LWIR), and End User (Defense, Automotive, Healthcare and Life Sciences, Oil and Gas, Mining, Utilities, Food and Beverages, Datacenters, and Others)] and Acoustic Imaging [End User (Mining, Utilities, Food and Beverages, and Others)]

Australia and New Zealand Thermal and Acoustic Imaging Market 2031

Download Free Sample

Thermal imaging, with its numerous benefits, has a wide range of applications in the military and defense sectors. The army and navy commonly utilize it for border surveillance and law enforcement operations. Additionally, thermal imaging plays a crucial role in ship collision avoidance and navigation systems. In aviation, it has significantly reduced the risks associated with flying in low-light and nighttime conditions. The technology is extensively used in military aviation for identifying, locating, and targeting enemy forces. Thermal imaging has also been adopted in civil aviation to monitor aircraft health and performance. Military electronics typically require extremely reliable components, owing to the high monetary, operational, and personnel costs associated with failures. As a result, many different types of components are screened using acoustic imaging before being mounted on a PCB.

The rise in military expenditure contributes to the procurement of various advanced surveillance and imaging technologies. Thermal and acoustic imaging systems are critical for military missions such as border patrol, maritime security, combat operations, and intelligence gathering. These systems offer real-time situational awareness and can detect and track potential threats in any environment, day or night. Thus, the rise in military expenditure fuels the Australia and New Zealand Thermal and Acoustic Imaging Market growth.

The scope of the Australia and New Zealand thermal and acoustic imaging market report focuses on thermal imaging (type, technology, wavelength, end user) and acoustic imaging (end user).

Based on type, the thermal cameras segment held the largest Australia and New Zealand thermal and acoustic imaging market share in 2023. Thermal cameras detect invisible heat radiation emitted or reflected by all objects, regardless of lighting conditions. These cameras work on the principle that all objects with a temperature above absolute zero emit infrared radiation, and the amount of radiation emitted varies with temperature; the hotter the object, the higher the frequency of that radiation. These cameras are designed for noncontact temperature measurement. They are widely adopted for various applications such as building and home inspections, electrical and mechanical maintenance, security and surveillance, automotive diagnostics, agricultural monitoring, firefighting and search and rescue, and (scientific) research and development. For example, in building and home inspections, these cameras are important to detect hidden issues by converting energy inefficiencies, such as poor insulation, air leaks, moisture intrusion, and electrical faults, into visible images. This helps the operators and homeowners prioritize repairs, which is likely to have a significant impact on the Australia and New Zealand thermal and acoustic imaging market forecast in the coming years.

Based on technology, the cooled segment held a larger Australia and New Zealand thermal and acoustic imaging market share in 2023. Cooled imagers are bulkier than uncooled imagers, but they offer very high image quality and are compatible with longer-range lenses. A modern cooled thermal imaging camera incorporates an imaging sensor with a cryocooler, which reduces the sensor temperature to cryogenic levels. This reduction in sensor temperature is required to reduce thermally-induced noise to a level lower than the signal from the scene being imaged. Even though cooled thermal imaging cameras are more expensive than uncooled ones, they have several advantages. Features of cooled thermal imaging cameras, such as high sensitivity, longer detection range, faster response, and stable performance, make them suitable for applications such as aerospace and ships.

Teledyne FLIR LLC; Testo SE & Co. KGaA; Fluke Corporation; UNI-TREND TECHNOLOGY (CHINA) CO., LTD.; Hangzhou Microimage Software Co., Ltd.; Megger Group Limited; and SDT International SA/NV are among the key players profiled in the Australia and New Zealand thermal and acoustic imaging market report. Several other major players were also studied and analyzed in the market report to get a holistic view of the market and its ecosystem. The Australia and New Zealand thermal and acoustic imaging market analysis provides detailed market insights, which help the key players strategize their growth.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com