Increasing Urbanization with Government Investments in Highways Construction Drives Market Growth

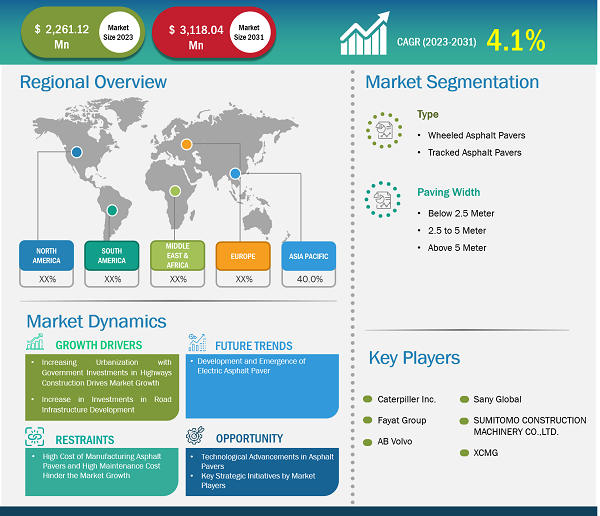

According to our latest market study on "Asphalt Paver Market Forecast to 2031 – Global Analysis – by Type and Paving Width," the market is expected to grow from US$ 2,261.12 million in 2023 to US$ 3,118.04 million by 2031; it is expected to register a CAGR of 4.1% from 2023 to 2031. Apart from growth drivers, the report covers the asphalt paver market trends and their foreseeable impact during the forecast period.

Increased government budget allocation for road infrastructure development across the world is a major driving factor for the growing global asphalt paver market size. Countries such as the US, China, India, and Germany are growing at a rapid pace owing to increased government funding for road and highway infrastructure developments. These countries have held a major share of the asphalt paver market and other road construction equipment markets owing to increased private and public investments in road and highway infrastructure development. As per the Indian Ministry of Housing and Urbanization, around 7,978 projects were initiated across 100 smart cities in India with a budget allocation of US$ 8.8 billion for the road infrastructure development project. Further, in January 2024, the Government authorities in Japan announced their plans to invest US$ 1.5 billion in more than nine projects related to road infrastructure in India to strengthen the road connectivity between the Northeast Road Network in the country.

Asphalt Paver Market

Asphalt Paver Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Wheeled Asphalt Pavers and Tracked Asphalt Pavers), Paving Width (Below 2.5 Meter, 2.5 to 5 Meter, and Above 5 Meter), and Geography

Asphalt Paver Market Overview and Forecast by 2031

Download Free Sample

Source: The Insight Partners Analysis

Further, according to the National Asphalt Pavement Association, total spending by the US government on highway development, such as new highway construction, reconstruction, resurfacing, renovation, and rehabilitation, was around US$ 105 billion in 2022. Also, the US federal government invests more than US$ 4.8 billion per year in the Airport infrastructure development Program. In addition, the US Federal government revealed its plans to provide US$ 550 billion for infrastructure development, including roads, bridge construction, mass transit, water infrastructure, and others, during the fiscal years 2022–2026. In 2022, in Germany, government investment in road infrastructure reached around US$ 30.95 billion. Thus, increasing investments by various countries' governments in road infrastructure development drive the asphalt paver market growth.

Key Strategic Initiatives by Market Players Propel Asphalt Paver Market Growth

Key players operating in the asphalt paver market adopt strategies and developments such as product developments, new product launches, agreements, partnerships, acquisitions, and others to stay competitive in the global market. Following are a few strategies announced by the key market players.

- In April 2024, Heartland Paving Partners acquired S&K Asphalt and Concrete, an Akron-based paving contractor. Through this acquisition, Heartland Paving Partners strengthened its position in the US asphalt paver market, especially in Ohio.

- In December 2023, Ammann Group signed an agreement to acquire Volvo Construction Equipment’s (Volvo CE’s) global ABG Paver business. The acquisition is aimed at strengthening the Ammann Group’s position in the asphalt paver market by expanding its distribution network and strengthening the product portfolio.

- In March 2023, LeeBoy launched a new asphalt paver machine named 8608 asphalt pavers. The new product consists of an efficient narrow conveyor management system and will be used in heavy commercial paving and large-volume paving application areas.

- In August 2023, Weiler launched two new commercial tracked asphalt pavers—120-HP P385C and 74-HP P285. The new products offer various new features, such as improved conveyor drive systems, variable speed and reversible conveyors, and reliable heat systems.

Such key strategies adopted by the players fuel the asphalt paver market growth.

An asphalt paver is used to spread asphalt evenly to construct smooth and durable roads, parking lots, and other paved areas. Asphalt is known to last 20 years or more when maintained properly, making it a cost-effective choice in the long run. In addition, asphalt road offers a smooth surface, which allows for better traction and provides an improved ride experience. Additionally, asphalt pavers can be erected quickly and can help in completing road construction quickly, resulting in fewer traffic disruptions and faster project deliveries. There are two types of asphalt pavers used in the road construction sector—wheeled asphalt pavers and tracked asphalt pavers. In the asphalt paver market share analysis, the wheeled asphalt pavers segment held a larger share in 2023.

Wheeled asphalt pavers consist of rubber tires used for smaller paving construction or areas with less space. These pavers reduce the time owing to their ability to transport faster between job locations. They offer high mobility for construction projects that require much paver movement. Increasing investments in road infrastructure development across the world fuel the demand for asphalt pavers. According to the American Road & Transportation Builders Association, US$ 53.5 billion invested in over 29,000 new projects in the US in 2022. Thus, rising initiatives toward road infrastructure development across the world boost the asphalt paver market share for the wheeled asphalt paver segment.

The scope of the global asphalt paver market report entails North America, Europe, Asia Pacific, and the Rest of World. The construction industry in the US is growing with the increasing number of commercial, residential, and civil engineering projects. A progressive construction sector propels the demand for construction equipment such as asphalt paver machines in the US. Population growth, increasing urbanization, and numerous ongoing infrastructure projects are among the factors boosting the demand for asphalt pavers in the country. According to the Associated General Contractors, the construction sector is one of the prime contributors to the US economy, and it generates ~US$ 2.1 trillion worth of structures each year. Burgeoning construction activities owing to government initiatives toward improving roads and building bridges in remote and rural parts also benefit the asphalt paver market in the US.

In 2023, LeeBoy collaborated with General Motors and Powertrain Control Systems and introduced the 8520C E-Paver, a prototype electric paver. In 2022, Dynapac introduced a new model of highway pavers at World of Asphalt with a goal to strengthen its paver's production in the US; the newly introduced D30T features a customized design. In 2022, Astec Industries, Inc. (Roadtec) launched a new, advanced operator control system for all Roadtec RP-series highway-class asphalt pavers. Such developments by key players in the US contribute to the growing asphalt paver market size.

In Asia Pacific, the presence of a large population has led to an increased demand for infrastructure construction. The region comprises several developing economies, including India, and many other Southeast Asian countries, which poses a strong demand for different infrastructure projects. Further, governments of various countries are taking several measures to attract private investments in infrastructure development projects. Increasing investments in residential, commercial, and infrastructure construction projects are boosting the demand for construction machines, including asphalt pavers. In 2022, an investing firm, KKR, raised US$ 6.4 billion for infrastructure projects in Asia. In addition, in 2023, the Indonesian government announced the finalization of 190 National Strategic Projects (PSN) worth US$ 95 million. This project includes the construction of toll roads, dams, airports, and others. In 2024, the Philippine Department of Public Works and Highways (DPWH) announced the completion of a road infrastructure project. Such initiatives are driving the asphalt paver market in Asia Pacific. According to the United Nations Economic and Social Commission for Asia and the Pacific Survey, Asia Pacific would plan to invest more than US$ 196 billion annually in road transportation and water and sanitation infrastructure development and also invest US$ 434 billion in clean energy.

Sany Global; XCMG; Changlin; Liugong; Shantui; XGMC; Zoomlion; Kesar Road Equipments; Uniter Engineering Products; Shitla Road Equipments; Sumitomo Heavy Industries, Ltd.; Sapna Constructions Company; HANTA MACHINERY Co., Ltd.; TOAROAD CORPORATION; Unipave Engineering Products; and Ashtvinayak Industries are among the major companies operating in the asphalt paver market in APAC.

The asphalt paver market analysis is carried out by identifying and evaluating key players in the market. AB Volvo, Astec Industries Inc., Caterpillar Inc., Sany Heavy Industry Co Ltd., Sumitomo Corp., S.P Enterprise, XCMG Construction Machinery Co Ltd., Deere & Co, FAYAT GROUP, and Leeboy are among the key players profiled in the asphalt paver market report.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com