Increasing Number of Contracts for Supply of Artillery Systems is Boosting Artillery Systems Market Growth

According to our latest study on "Artillery Systems Market Analysis and Forecast to 2031 – by Caliber, Range, Type, and Component," the market is expected to grow from US$ 11.99 billion in 2023 to US$ 20.98 billion by 2031; it is anticipated to record a CAGR of 7.2% from 2023 to 2031. The report includes growth prospects owing to the current artillery systems market trends and their foreseeable impact during the forecast period.

Manufacturers operating in the artillery systems market strongly focus on collaborating with different governments and armed forces to comprehend their respective demands and offer them suitable solutions. The military forces of various countries are providing numerous contracts to artillery systems manufacturers to procure several communication, surveillance, and navigation systems. Moreover, the defense forces of different nations are investing substantially in procuring artillery systems such as rocket artillery, mortars, and howitzers. Artillery systems are reliable for taking down short, medium, and long-range targets. They enable armed forces to facilitate enhanced remote firing on ground or naval platforms.

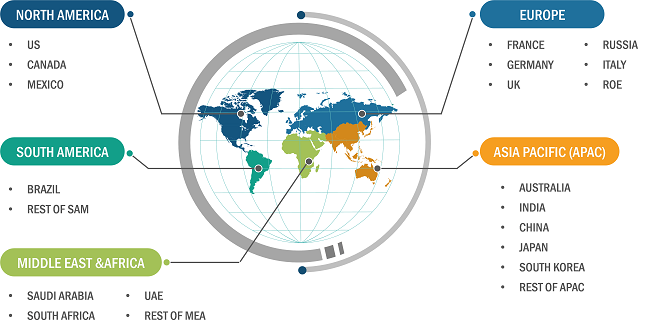

Artillery Systems Market Share — by Geography, 2023

Artillery Systems Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Gun Turret, Fire Control System, Ammunition Handling System, Auxiliary System, and Others), Range (Short Range, Medium Range, and Long Range), Caliber (Small Caliber, Medium Caliber, and Large Caliber), Type (Howitzer, Mortar, and Rocket Artillery), and Geography

Artillery Systems Market Forecast and Size by 2031

Download Free Sample

Source: The Insight Partners Analysis

The majority of the countries' armed forces have been investing heavily in the procurement of artillery systems. A few examples are mentioned below:

- In December 2023, Poland's State Armament Agency announced that it had purchased K9 Howitzers from South Korea as a part of the US$ 2.6 billion deal with Hanwha Defense.

- In November 2023, BAE Systems won a contract worth US$ 63 million from the US DoD to produce self-propelled Paladin howitzers and ammunition carrier vehicles.

- In September 2023, the Indian Army passed a proposal to purchase 400 units of howitzers worth US$ 48 million from Indian firms.

- In November 2023, Hanwha Aerospace awarded a contract to supply 155 mm artillery bi-modular charge systems to BAE Systems Plc.

- In December 2022, the Indian Defence Ministry issued a Request for Proposal to L&T for producing 100 units of K9 Howitzers through Hanwha Defense Technology.

- In April 2023, Elbit Systems Ltd won a contract worth US$ 102 million to supply ATMOS artillery systems to an undisclosed international customer.

Such contracts have been accelerating the artillery systems market growth across different regions.

The artillery systems market is segmented into component, range, caliber, type, and geography. Based on component, the market is divided into gun turret, fire control system, ammunition handling system, auxiliary system, and others. By range, the market is categorized into short range, medium range, and long range. In terms of caliber, the market is subsegmented into small caliber, medium caliber, and large caliber. Based on type, the market is segmented into howitzer, mortars, and rocket artillery. Geographically, the artillery systems market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Based on component, the artillery systems market is segmented into gun turret, fire control system, ammunition handling system, auxiliary system, and others. The fire control system segment held the largest artillery systems market share in 2023. Fire control system is one of the most expensive and important components of any artillery system. Many countries have been investing a significant portion of their respective military expenditure for the procurement of advanced fire control systems for their existing artilleries. Rising procurement of new artillery systems by different countries and increasing modification of existing artillery systems are among the factors propelling the demand for fire control systems across different regions. For instance, in March 2023, the Indian Navy awarded a contract worth nearly US$ 204 million to BEL for the procurement of fire control systems for their respective naval fleet of artillery guns. Similarly, in September 2023, Elbit Systems Ltd won a contract worth US$ 200 million for supplying C4I solution to artillery battalions and a Hostile Fire Counter Attack (HFCA) system to an undisclosed customer in the European Union. Such factors are promoting the growth of the fire control system segment in the global artillery systems market.

The scope of the artillery systems market report focuses on North America (the US, Canada, and Mexico), Europe (Spain, the UK, Germany, France, Italy, and the Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South America (Brazil, Argentina, and the Rest of South America).

In North America, military expenditure is significantly increasing due to rising geopolitical tension. According to the Stockholm International Peace Research Institute (SIPRI), the military expenditure of the region was US$ 840.27 billion in 2021; it increased to US$ 912.37 billion in 2022 and reached US$ 955 billion in 2023. Increased budgets allow for the incorporation of cutting-edge technologies into artillery systems. This might include improvements in communication systems, targeting capabilities, and the development of precision-guided munitions, making the artillery more sophisticated and effective. For instance, in July 2023, OKSI secured a follow-on contract valued at US$ 2 million from the United States Special Operations Command (USSOCOM) to finalize the development of their Precision Guidance Kit (PGK) designed for the 81 mm mortar round. The innovative screw-on 81 mm PGK technology is poised to empower warfighters by enabling precise guidance of mortars toward specific impact points or predetermined targets. This advancement in mortar technology allows for the transformation of a historically less accurate area weapon into a precision munition, ensuring first-round effects.

The Ukraine-Russia conflict has contributed to the growth of the global artillery systems market size. While North America, primarily the US and Canada, is not directly involved in the conflict, several factors influence the regional military equipment market landscape. North American nations, particularly the US, have provided military support to Ukraine in response to the conflict. This support often includes the supply of advanced weaponry, possibly contributing to an increase in demand for military hardware, including artillery systems. The conflict reinforces the importance of strategic alliances and partnerships among North American nations and their allies. Collaborative defense efforts may involve joint development programs or the exchange of military technologies, propelling the artillery systems market size. For instance, in December 2022, Lockheed Martin secured a new Pentagon contract as part of President Joe Biden’s latest Ukraine security package. This contract was valued at US$ 430.9 million. It is expected to boost the production of rocket launchers and precision-guided missiles at Lockheed Martin's extensive manufacturing facility in East Camden, Arkansas. The contract specifically focuses on scaling up the production of High Mobility Artillery Rocket Systems (HIMARS) M142 launchers, a pivotal component that has proven to be a strategic asset in the ongoing conflict in Ukraine. Similarly, in April 2022, Canada played a vital role in reinforcing Ukraine's security forces by supplying M777 howitzers and accompanying ammunition. This collaborative effort, conducted in partnership with American Allies, involved the utilization of equipment from the inventory of the Canadian Armed Forces. The provision of M777 howitzers and ammunition is part of a substantial support initiative aimed at addressing the persisting security challenges in the region.

Avibras Indústria Aeroespacial S/A, BAE Systems Plc, Nexter Groupe KNDS, Denel Land Systems, Elbit Systems Ltd, General Dynamics, ST Engineering, Lockheed Martin Corporation, Rheinmetall AG, and Mandus Group are among the key players profiled in the artillery systems market report. Companies in the artillery systems market mainly focus on product and service enhancements by integrating advanced features and technologies into their offerings.

Contact Us

Phone: +1-646-491-9876

Email Id: sales@theinsightpartners.com